TALLAHASSEE, Fla. — Roughly 100,000 Floridians insured by Farmer's Insurance will soon be looking for new policies. Farmers is the latest domino to fall in the ongoing property insurance crisis in the state, and the finger-pointing from Tallahassee has already started.

"We warned early on that conditions could potentially get worse before they get better,” Mark Friedlander with the Insurance Information Institute said.

That's the only way to sum up the status of Florida’s property insurance market right now.

In the past 18 months, which saw two special legislative sessions aimed at the issue; seven insurers have gone insolvent, 15 stopped writing policies and now a fourth is leaving the state.

"Ongoing volatility in the private market has led to certainly a precarious situation for many consumers,” Friedlander added.

In a scathing statement, Florida Chief Financial Officer Jimmy Patronis vowed to hold Farmers Insurance accountable, saying they are playing politics and their actions "are less a representation of the Florida market, and more of bad leadership at the insurer."

Patronis, state Republican lawmakers and industry experts believe reforms the state made to wrangle frivolous litigation, in time, will have a positive impact on the market.

"We were very supportive of the reform bills that were passed and signed into law and feel they will bring stability to Florida's property insurance market," Friedlander added.

"While our reforms will take time to take effect, we put the right systems in place to strengthen our insurance market and provide Floridians with the access to coverage and peace of mind they need for their property," Florida House Speaker Paul Renner, R-Palm Coast, tweeted.

Though state Democratic lawmakers say not enough is being done, placing the blame on Republican leadership for not getting on top of rising costs.

"If lawsuits are the reason why didn't Farmers site that is one of its reasons for leaving this market," State Rep. Fentrice Driskell said during a press conference Wednesday. "Let me just say this to make it very clear. Trickle-down economics doesn't work and neither does trickle-down property insurance relief," Driskell added, referring to the $3 billion the state put into a reinsurance fund for insurance companies.

While many policyholders are wondering what's next and dealing with rising premiums, the state's Office of Insurance Regulation (OIR) has concerns about 18 other companies on a watchlist right now.

"18 of 47 Florida residential insurers are on that list. That's really our biggest concern right now," Friedlander explained, because we've seen in the past, some companies on the watch lists end up in insolvency. We're not predicting that. We're certainly not hoping that happens."

Thousands of homeowners will soon get non-renewal notice but this isn't just a Farmers Insurance issue, more and more Floridians have been getting them as the market struggles.

Due to state law, consumers have to be notified by their insurers 120 days prior to their non-renewal. So what steps should Floridians take if their coverage gets dropped?

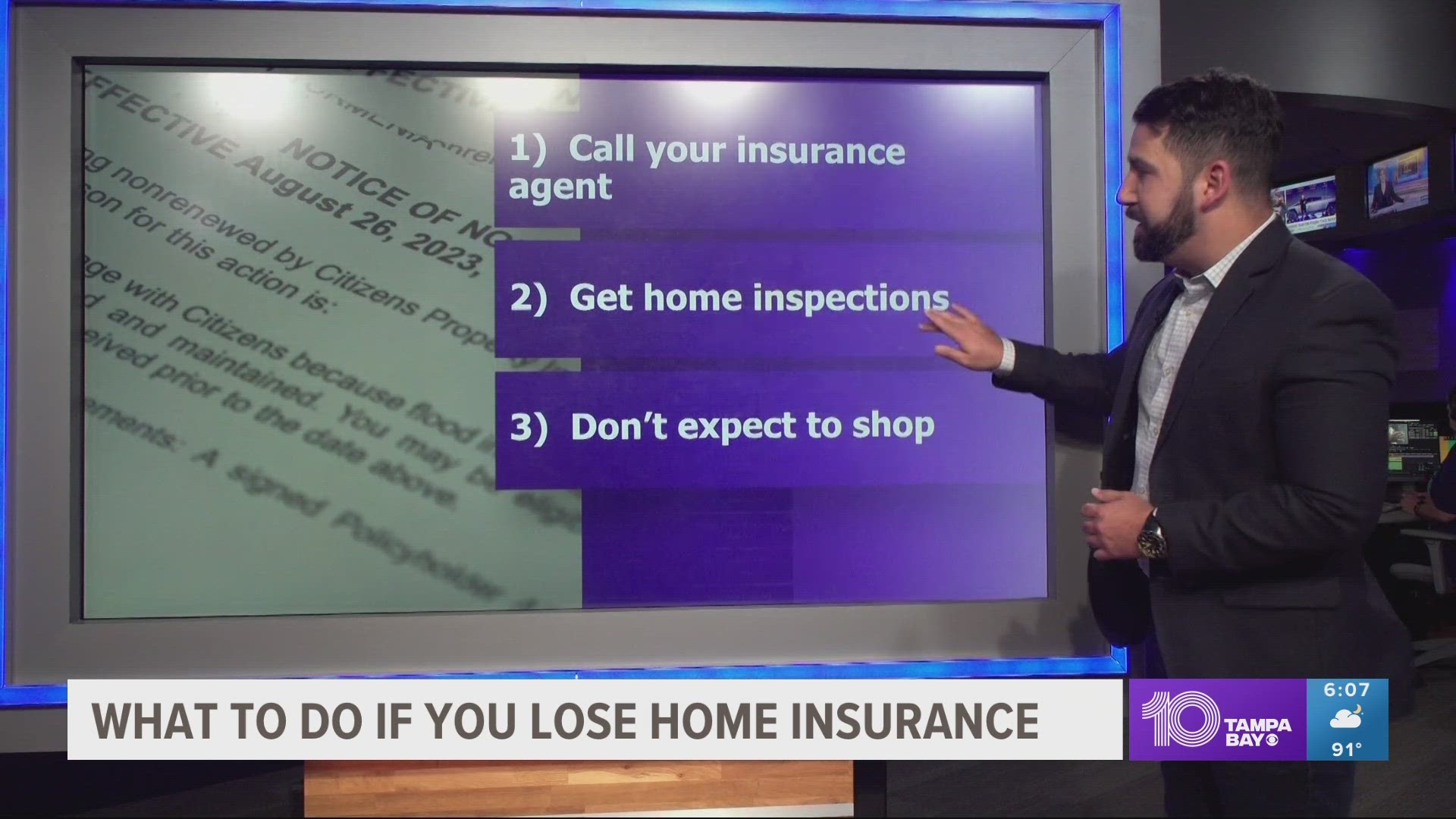

We spoke with Kathy Walsh, agency owner at Coast to Coast Insurance in Tampa. She says the first thing you should do is call your insurance agent.

"See if the agent offers other options, they may have other markets, and they may have Citizens as a choice, Citizens is not a choice for every homeowner, but it is for the bulk of the industry,” Walsh said.

You only qualify for the state-backed Citizens (which is approaching a record number of policies) if you weren't offered coverage by anyone else or the premiums offered were 20% more than Citizens.

The second thing an agent will likely tell you to do is get your home inspected and make sure your roof isn’t too old.

"First thing to do is age of roof," Walsh added. "If the home is 20 years or older they should get a four-point inspection and wind mitigation inspection. They need those things in order for us to go ahead and look at the market for them."

She says homeowners should act quickly and don't expect to shop around.

"The market's slim," Kathy added. "It's not where can I get the price, it’s where can I get coverage for my home."

The state's Insurance Consumer Advocate is also available to help Floridians with insurance issues and even has resources to show you what fair rates in your area are. Granted, you will be paying a lot more than the national average.