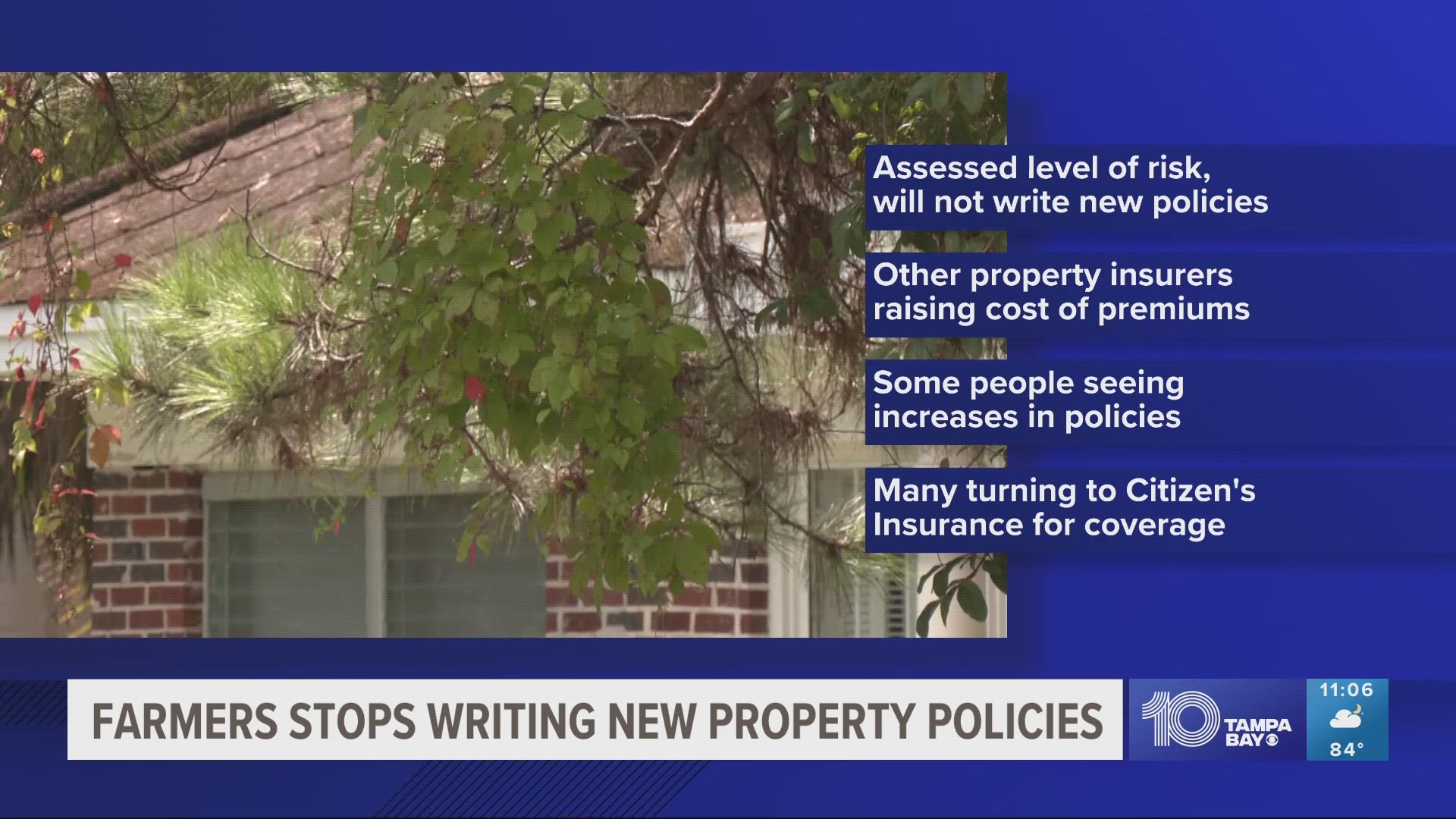

ST. PETERSBURG, Fla. — A major property insurer in Florida is putting a pause on writing new homeowners policies due to the increased risk of catastrophic weather.

As Florida deepens into hurricane season, Farmers Insurance Group is taking a refreshed look at the state — and, ultimately, what level of risk it's comfortable with.

"With catastrophe costs at historically high levels and reconstruction costs continuing to climb, we implemented a pause on writing new homeowners policies to more effectively manage our risk exposure," Famers Insurance Group said in a statement.

The pause comes on the heels of other property insurance companies raising the costs of their premiums. Some people may see an increase of as much as 40% depending on where they live in the state.

“It’s a very difficult situation, we understand it. Unfortunately, we’re not seeing any relief shortly for Florida homeowners,” Mark Friedlander with the Insurance Information Institute said in a previous interview. “While there's been a lot of reforms put in place in recent months, passed by the state legislature, all very positive actions taken by the legislature, it takes time for those reforms to show positive trends in the marketplace."

In the meantime, the state-backed Citizens is approaching a record number of policyholders, which Friedlander says indicates people are having trouble simply finding coverage.

And costs will likely only go up from here. June 1 marked a reinsurance renewal period for many insurers — experts are anticipating spiking costs for companies that will then be handed down to consumers.

Florida homeowners are not the only homeowners facing possible insurance woes. On the other side of the country, California homeowners are also learning that some insurers, including State Farm, would no longer accept new insurance policy applications for both person and business properties.

AIG exited the homeowners' insurance market in California back in January 2022, as well as Allstate, which is the fourth-largest property insurer in California more recently in June, according to Vox.

“The number of acres burned in California has grown steadily in recent years, as more people are moving into fire-prone areas of the state,” the Insurance Information Institute said in a statement. “More homes in harm’s way – combined with rising costs of repairing or replacing houses either damaged or lost to fire – leads to increased insured losses. On top of all of this are the underwriting challenges associated with public policy in the state.”

10 Tampa Bay's Aaron Parseghian contributed to this article.