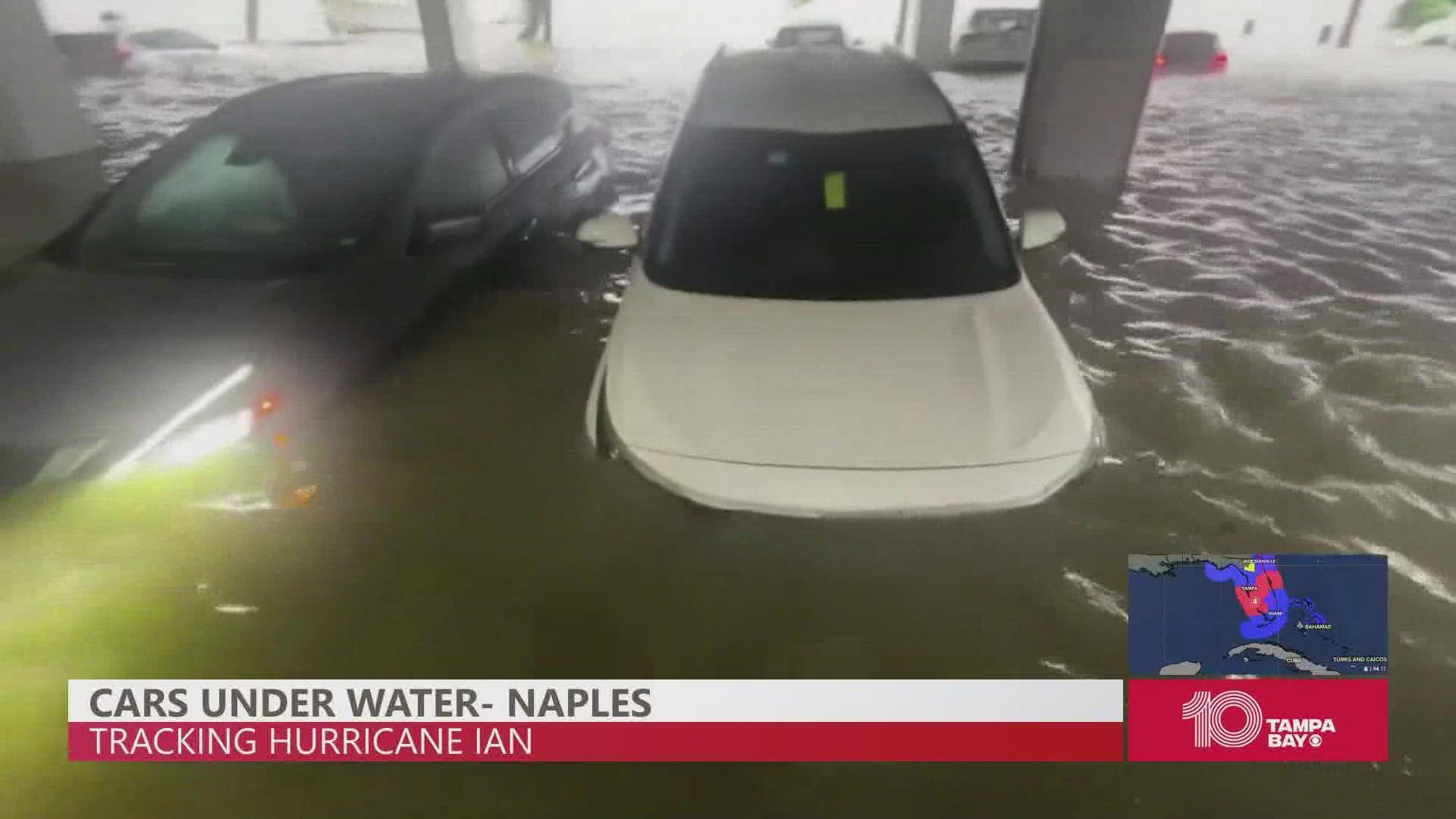

ST. PETERSBURG, Fla — Many vehicles have been impacted by the high waters Hurricane Ian brought in as a Category 4 hurricane.

Floods were seen across the state from Fort Myers to Kissimmee.

Florida is one of the states with the most flood-damaged vehicles on the road as of 2019, according to a WESH report. At that time, Carfax estimated 34,000 water-damaged vehicles to be for sale in Florida.

Despite suffering damage that could impact the vehicle's performance and overall longevity, there are laws that regulate the resale of these cars.

In 2014, a spokesperson for the Florida Department of Motor Vehicles told the Pensacola News Journal that Florida statutes require titles of vehicles that have suffered water damage to indicate in a conspicuous place that those vehicles have suffered flood damage.

The Pensacola News Journal reports that Florida Statute 319.14(1)(b) states “a person may not knowingly offer for sale, sell, or exchange a rebuilt vehicle” after flooding until it has been inspected and declared a “flood vehicle” by the state Department of Highway Safety and Motor Vehicles.

Under state law, a “flood vehicle” means one that has been deemed to be a total loss. Florida law also requires that any vehicle rebuilt using parts from others that were flooded must have that fact noted on the title.

A Carfax representative told WESH the issue with water-damaged vehicles is that, essentially, they rot from the inside out. Water can affect mechanical, electrical, and safety systems in vehicles, as well as cause bacteria and mold growth that a driver or passengers could then breathe in.

According to Consumer Reports, a car that was swept up by hurricane damage is almost certainly totaled, and a person's compensation will depend on their car insurance coverage.

Loretta Worters, vice president at the Insurance Information Institute, told Consumer Reports that flood insurance is covered under the comprehensive portion of a car insurance policy.

How to file a typical insurance claim

1. Contact your insurance or agent you hold your policy with. Consumer Reports says that many times, insurers may have disaster response stations or could be setting them up in areas that may have suffered damage.

2. Document your property damage by taking photos and videos as soon as you can, if you can do it safely. Then, make sure to provide these to your insurance agent, Consumer Reports says.

3. Finally, Consumer Reports says owners should get a claim number with the name and phone number of the adjuster. It says to ask for a payout estimate, when you can expect to be contacted, and if you'll need reimbursement for renting a car.

Ultimately, Consumer Reports warns that in times of large-scale flooding, you may be one of the thousands of car owners looking to have a vehicle assessed, repaired, or replaced. It may take time for these processes to take place.