NORTH PORT, Fla. — Thousands of Floridians are left with little answers after insurance companies denied property claims.

Sarasota County has the third-highest number of reported claims in the state with 70,514 claims reported. Of those claims, 17,886 were denied money. Lee County leads the state, more than tripling the number of claims in Sarasota County, with 246,161 claims reported and 48,334 closed without payment.

One North Port family is sharing their story of being shorted by their insurance company in hopes to create change.

Nicholas Mancini owns a home in North Port in the County Club Estates community. When he saw the forecast for Hurricane Ian, he and his family went to Boston to escape the storm.

His neighbor, Lucky Roman, sent him pictures of the damage to his house

"It was a disaster," Roman said. "Everything was gone. Filled with water. The roof was gone."

Mancini didn't return to North Port because his house was unlivable with two young children. Roman documented pictures of mold throughout the house.

"Everything had mold on it," Roman stated.

Manchini filed a claim with his insurance company, Security First.

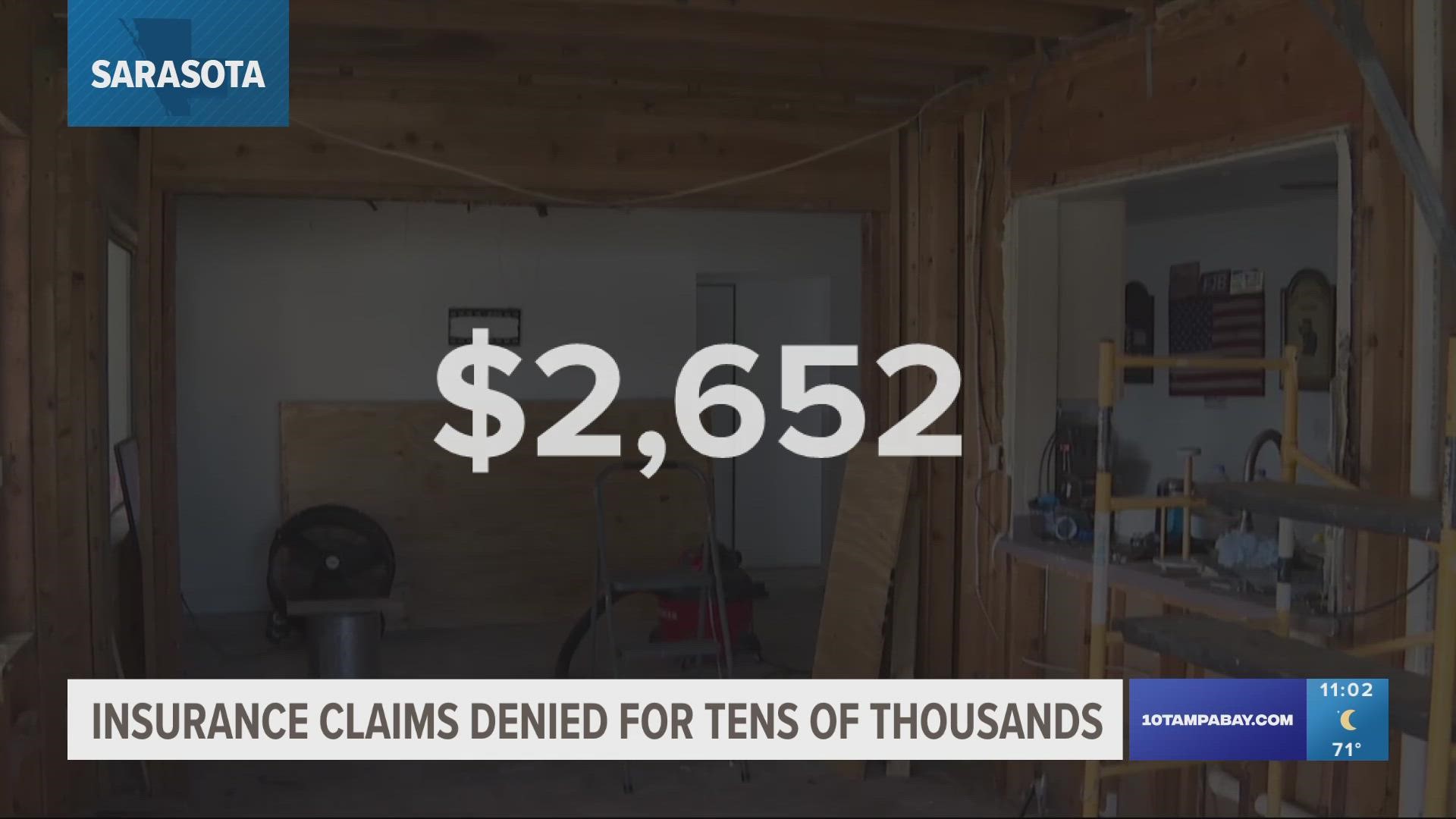

Mancini said an adjuster came out and explained the damage to his house totaled more than $60,000. Mancini said after that, Security First offered him $2,652, claiming some damage was because things weren’t installed properly.

Being lowballed by an insurance company isn't rare, according to legal experts.

10 Tampa Bay asked legal experts what people can do if their insurance company lowballs them or rejects their claim.

"Number one thing we recommend someone does is go hire a lawyer. It’s that simple," said Dante Weston, a Partner at Donaldson and Weston Law Firm.

Weston sees Nicholas’ case too often with people lowballed or rejected by insurance companies.

"People have to be really careful with what they sign because we have so many horror stories with people signing lowball offers," Weston explained.

If you sign an offer from your insurance company, that could mean you won't have the chance to get the money you deserve, depending on the offer you signed.

Weston believes this problem is larger than just Hurricane Ian claims. He has been dealing with these cases for decades.

He believes it's time for state officials to create change.

"It’s not good that it’s happening, but it's good that we’re putting a spotlight on it and hoping state and local officials step up and make a change," Weston added.

Manchini hired a Sarasota lawyer to deal with his case. Right now, he is paying out of his own pocket to live elsewhere until his house is safe for his family.

10 Tampa Bay reached out to his insurance company, Security First, to get clarity and answers as to why they won't pay him what the adjuster said his damages total. We’re waiting to hear back.