Tax season is officially underway, and scammers are already hard at work.

The IRS started accepting returns on Monday, January 29 for the 2023 tax season. This year's filing deadline is April 15.

10 Tampa Bay is VERIFYING your tax questions – including how the IRS will contact you about your tax refund.

Some people are reporting receiving emails and text messages with links regarding their refunds. But before you click, it’s likely a fake.

THE QUESTION

Will the IRS send you a text message or email about your refund?

THE SOURCES

THE ANSWER

No, the IRS doesn’t send tax refund information by email, text, or social media.

WHAT WE FOUND

If you get an email or text message claiming to be from the Internal Revenue Service about a tax refund, it’s a scam, according to the Federal Trade Commission.

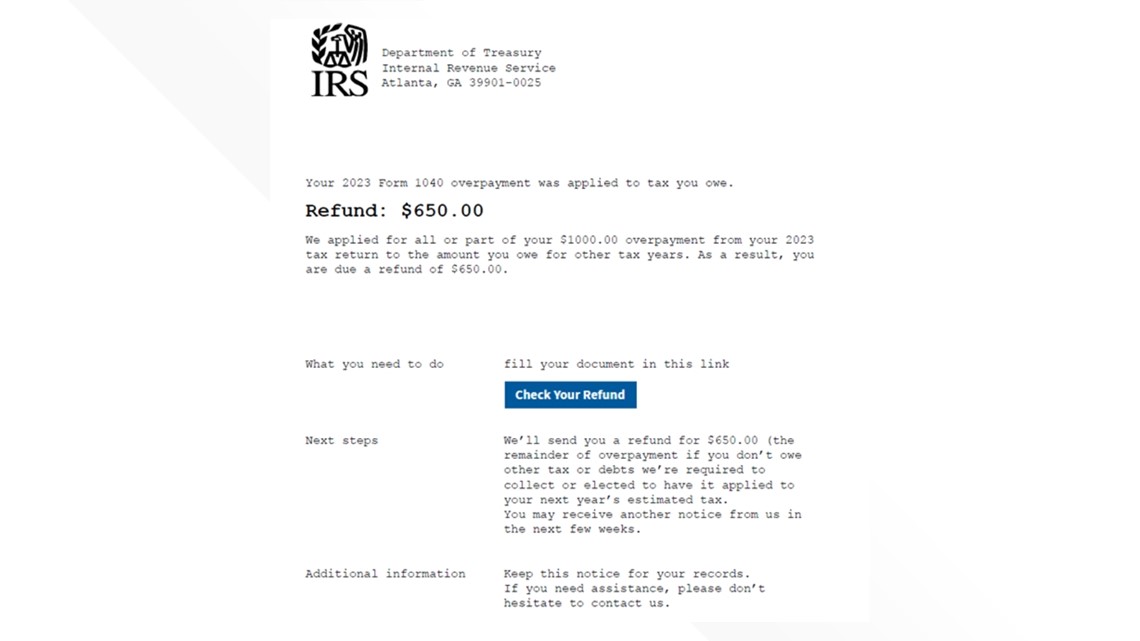

Scammers are sending messages about your “tax refund” or “tax refund e-statement” that might look legitimate with the IRS logo, the FTC warns. The messages include links to check your refund or to fill out a form to get your refund.

But clicking them could open you up to identity theft or let a fraudster install malware on your device, according to the FTC.

The IRS cautions it only contacts taxpayers through regular mail – or occasionally by phone.

On its website the agency states, “the IRS never initiates contact with taxpayers by email, text or social media regarding a bill or tax refund.”

If you are unexpectedly contacted about your tax refund, the IRS says it’s a scam.

You can report fraudulent messages to the IRS at phishing@IRS.gov or to the FTC at ReportFraud@ftc.gov.

There are better and safer ways to check the status of your refund using the ‘Where’s My Refund?’ tool on the IRS website or through the IRS2Go app.

The agency says it has updated its refund tracking tool with more information about a taxpayer’s refund. Now the IRS will be able to show taxpayers if additional information is needed with their return and other details.

You can get an additional layer of security with an Identity Protection PIN (IP PIN). You can apply to receive the six-digit number from the IRS which is valid for one calendar year to prevent someone else from filing a tax return using your Social Security number or Individual Taxpayer Identification Number.