ST. PETERSBURG, Fla. — With Florida's property insurance industry in turmoil, here's what you should be doing right now as Hurricane Ian approaches.

As you prepare your home, take photos and video both inside and out, according to Michael Barry with the Insurance Information Institute.

He said this will help you later on if you need to file a claim by giving you cut-and-dry examples of what your house looked like before and after the storm if you had damage.

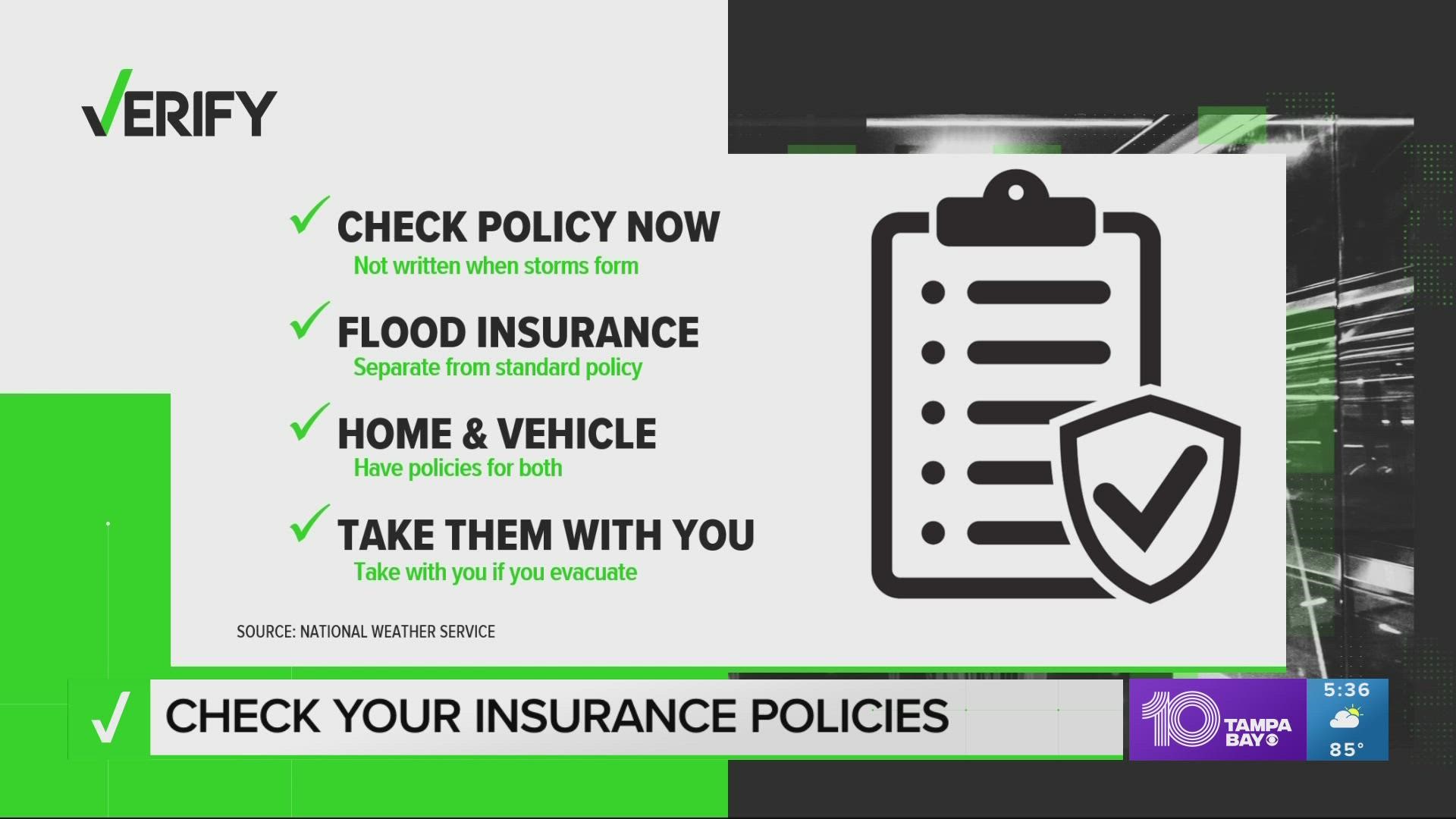

If you have homeowners or renters insurance, don't assume you're covered for any hurricane damage.

OUR SOURCES

- The National Weather Service

- Insurance Information Institute

THE QUESTION

Does standard homeowners or renters insurance cover flooding?

THE ANSWER

No, standard homeowners insurance doesn’t cover flooding. Both homeowners and renters need a separate policy to cover flooding. If you aren't covered for flood insurance, there's a 30-day required waiting period after setting it up.

So if a storm is already approaching, it's too late.

THE QUESTION

What about the more than 1 million Floridians who are now covered by the state-run insurer of last resort Citizens Property Insurance?

THE ANSWER

In a worst-case scenario, Citizens has the power to assess surcharges of all the policyholders statewide to help pay the claims.

"If I'm a Citizens policyholder today, and I get property damaged, Citizens Property Insurance is going to have the resources to pay the claim," Barry said.

During the 2004-05 hurricane season, Citizens went to the rest of its policyholders statewide to assess surcharges to pay out claims, according to Barry.