ST. PETERSBURG, Fla. — You’ve likely seen or heard the commercials warning that scammers and identity thieves are now stealing houses right out from under unsuspecting homeowners.

The companies behind these warnings say fraudsters can use forged signatures and fake IDs to transfer ownership of your property to themselves with the county’s register of deeds, a crime dubbed “house stealing” by the FBI.

For a monthly fee, these “home lock” companies offer monitoring services to alert you if someone attempts to do this with your property.

A VERIFY viewer texted us about these commercials asking if the protection being advertised was necessary.

THE QUESTION

Is this crime as common as these ads suggest and are paid monitoring services the only way to protect yourself?

THE SOURCES

- FBI

- FBI Tampa White-Collar Crime squad

- Steve Gottheim, American Land Title Association

- Bill Burgess, Pinellas County senior manager property recorder

THE ANSWER

Yes, home title theft is a real crime. But it is rare, according to the FBI, and easily preventable. Every Tampa Bay county offers free home title monitoring to alert you if someone attempts to fraudulently alter your deed.

WHAT WE FOUND

The FBI first reported on this type of fraud in 2008 when the agency coined the term “house stealing.”

Ads from “home lock” companies like this one warn this type of fraud is one of the fastest-growing crimes in America.

However, a spokesperson for the FBI told VERIFY that since the beginning of 2021, the agency has received fewer than 20 complaints, “which may be related to home title theft.”

Steve Gottheim with American Land Title Association, the national trade association representing thousands of title insurance companies, said the dire warnings make a mountain out of a molehill.

He said home title theft is not a widespread issue, even in areas with more vacation or secondary properties, which are seen as easier targets for this type of fraud.

“There's not much that we can see nationally that would suggest this is a growing crime trend that your average homebuyer should be worried about,” Gottheim told 10 Tampa Bay.

Florida law requires the person transferring ownership of a property to sign a deed in the presence of a notary and two witnesses.

But even if a notary is somehow forged, Gottheim said the fraudulent deed is worthless under state law. If a scammer were to try to sell your home, he said, it’s the problem of the buyers or lenders who failed to do their due diligence, not yours, he said.

“If it ever happened, a court would come in and say, no you’re still the owner of your property,” Gottheim said. “Just because somebody records something doesn’t mean it actually impacts your property.”

That’s not to say it can’t happen. It has. And in some cases, the scammers have faced criminal charges.

For homeowners concerned they could be at risk of having their deed forged and stolen, Gottheim says there’s no reason to pay for a monitoring service because many counties now offer the same monitoring for free.

“Those paid services are just monitoring, they're not actually there to help you if something actually does get recorded,” he said. “It’s really not providing much value for that payment.”

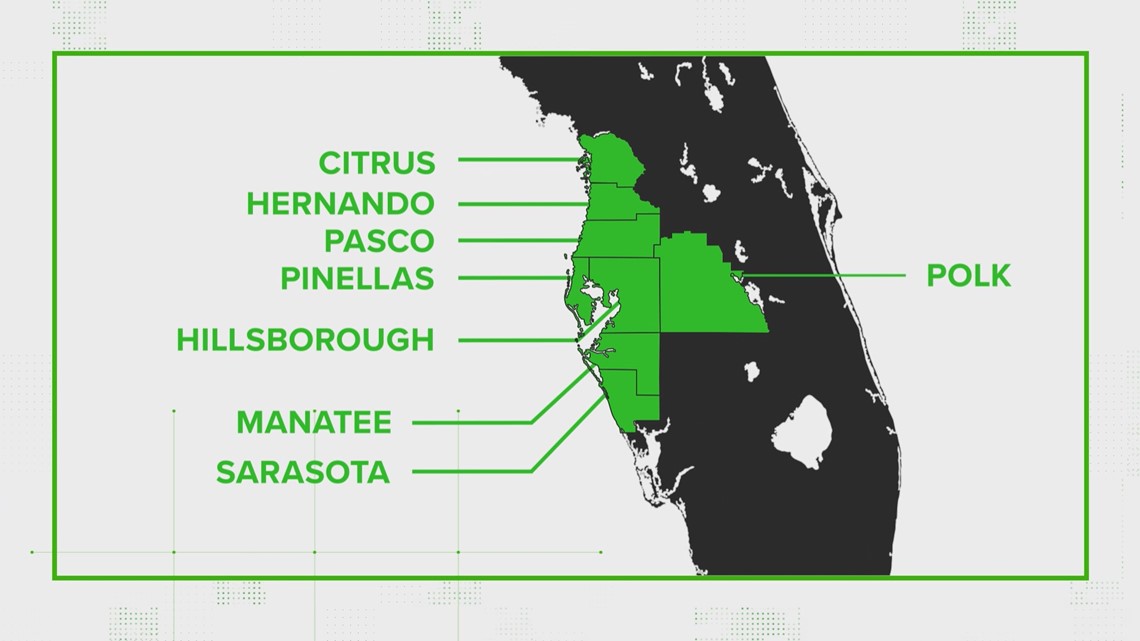

In Tampa Bay, VERIFY confirmed the following counties offer free property fraud monitoring. You can sign up for the service online, determine the personal or business names you want monitored and choose how to be notified if a document has been recorded with the county under the registered names:

In Pinellas County, the clerk’s office has not encountered any home title theft issues in the past several years, according to Bill Burgess, senior manager of the county’s property recording services. Often in cases where someone does receive an alert of activity involving their name, he said, it’s because someone with a similar name recently recorded a document with their office.

Gottheim said real estate crimes where scammers steal homebuyers’ down payments or earnest money are much more common.

In fact, most “title” complaints received by the FBI are related to email schemes where someone hacks into a title company email to intercept the wire transfer of a down payment, according to the supervisor of FBI Tampa’s White-Collar Crime squad.

As of last year, the FBI reported about $200 million is lost annually by homeowners who fall for this type of real estate wire transfer fraud.

The National Association of Realtors says you can protect yourself by verifying all wire instructions before transferring funds by calling the title company. If you’ve been targeted they recommend you call your bank immediately and report it to your local FBI office because making a report within the first 24 hours provides the best chance of recovering your money.