TAMPA, Fla. — After years of legal wrangling, state lawmakers this year approved what will happen to more than half a billion dollars collected through the now-voided Hillsborough transportation sales tax.

The Florida Supreme Court found the tax to be unconstitutional in 2021.

Outlined in the state budget signed by Gov. Ron DeSantis, the money will be divvied up between county road improvement projects, a county tax holiday, legal fees and a refund program for people who qualify. A judge approved a plan in late July detailing how and when notices would be sent to residents to file a refund claim.

VERIFY viewer Elizabeth K. forwarded an email she received that said she could submit a refund claim for up to $100.

Wary of scams, she wanted to know if it was legitimate.

RELATED: $569 million collected in a short-lived tax could go back to Hillsborough County for road projects

THE QUESTION

Are notices to submit a refund claim for the defunct Hillsborough transportation sales tax legitimate?

THE SOURCES

- Florida Department of Revenue

- Court documents, motion for preliminary approval of class action settlement

- General Appropriations Act

- FLTaxRefund.com

THE ANSWER

Yes, the refund process has begun for the voided Hillsborough County transportation sales tax.

WHAT WE FOUND

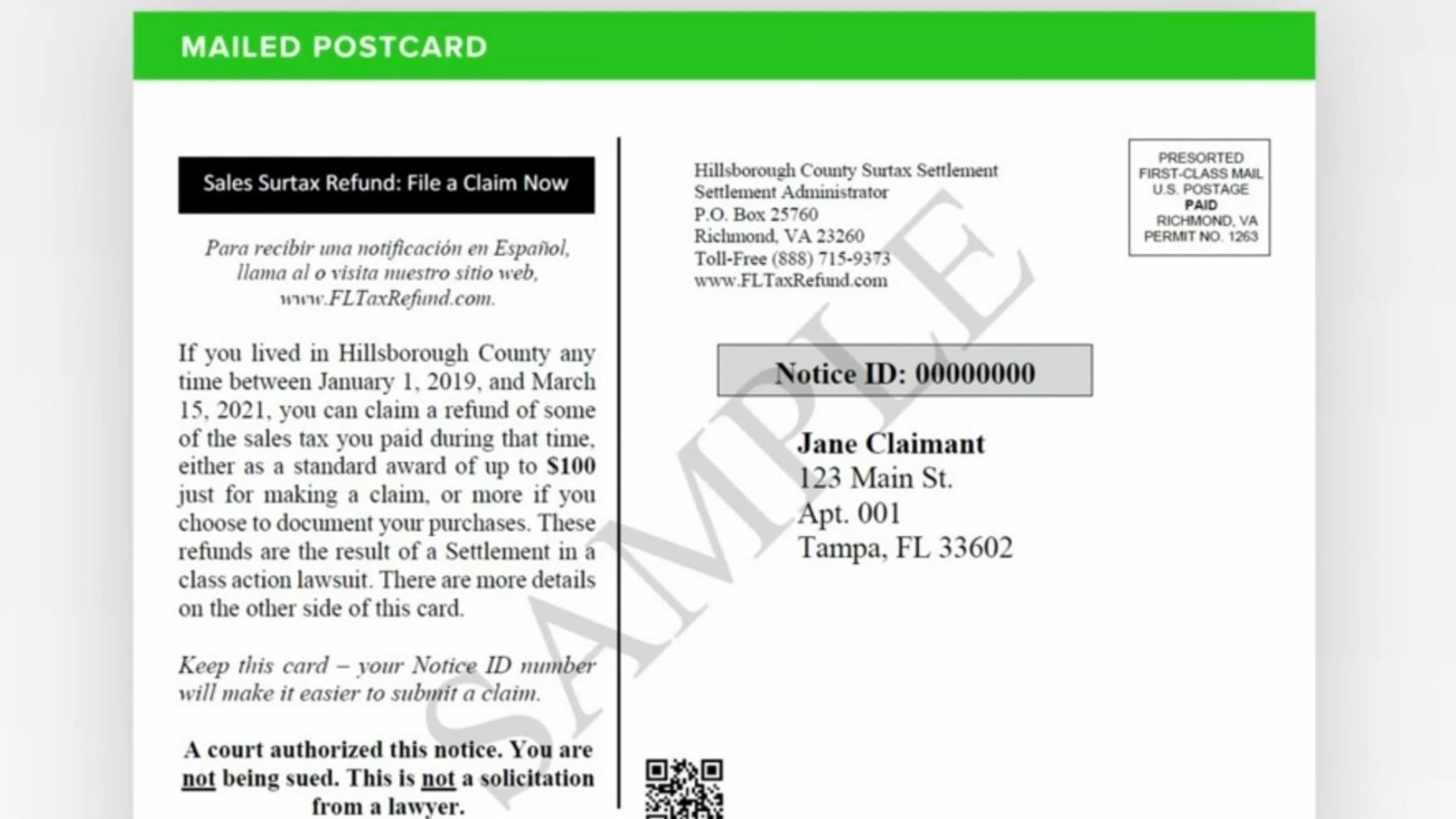

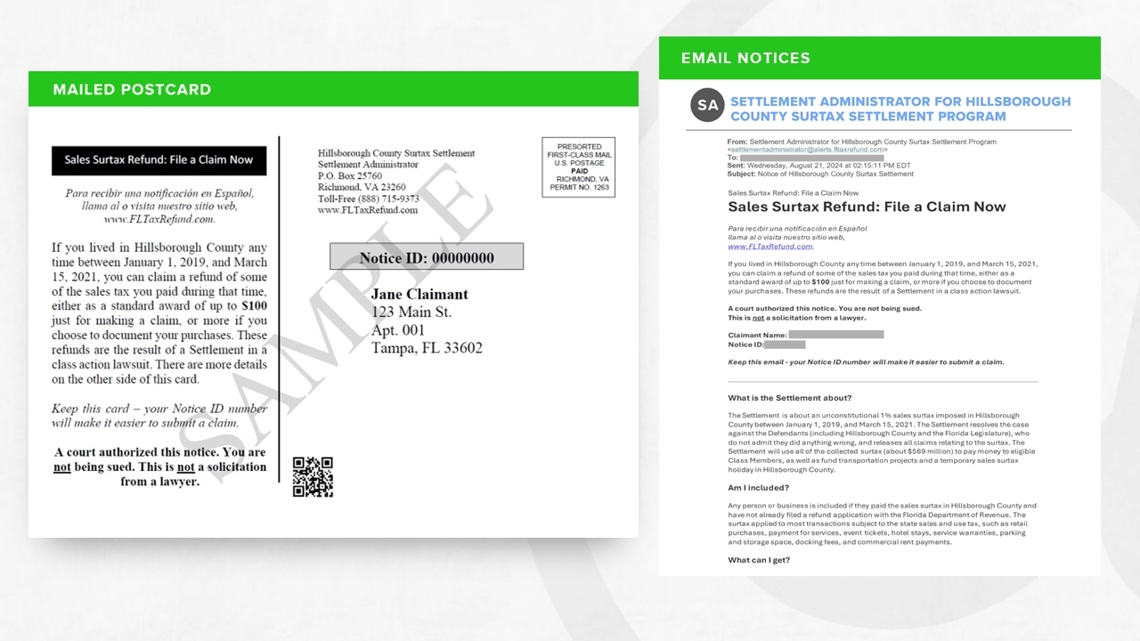

Emails and postcards to file a claim for a refund are the result of a settlement in a class action lawsuit against Hillsborough County and the Florida Legislature over the voided transportation sales tax.

The state budget, signed by DeSantis on June 12, directs the transfer of $170 million to a settlement fund.

A court-appointed claims administrator will oversee the process of providing refunds to impacted taxpayers with valid claims, according to a plan approved by a judge in July. The plan is detailed in a motion for preliminary approval reviewed by VERIFY.

The money will also be used to reimburse legal fees and costs to provide notice of the settlement.

If you can provide receipts or other proof of purchases, you may receive a refund equal to the amount of your surtax payments — whether you live in Hillsborough County or not, the settlement website says.

People without receipts will be eligible to claim up to $100 but must be able to show they lived in Hillsborough County during some period the tax was collected between Jan. 1, 2019, and March 15, 2021.

The transportation sales tax was applied to most transactions that were already subject to the state-wide sales and use tax. For many transactions, including retail purchases, this tax only applied to the first $5,000 of the sales amount, according to the settlement website.

As is the case in all class action settlements, ultimate payout amounts will depend on how many people file claims and qualify.

Any leftover money will be used to extend the sales surtax holiday.

County residents should receive a notice in the mail by the end of August. Email notices will also be sent, and anyone can access an official settlement website to submit a claim.

Legitimate emails will come from the Settlement Administrator for Hillsborough County Surtax Settlement Program (settlementadministrator@alerts.fltaxrefund.com) and will link to the website FLTaxRefund.com.

The emails and postcards are intended to make the claims process easier for people, but you do not need to receive a postcard or email to be eligible and submit a claim on FLTaxRefund.com

A call center can also be reached at 1-888-715-9373.

You must submit your claim online or by mail by Dec. 31, 2024.

The court will hold a hearing in November to consider whether to approve the settlement and the requested attorneys' fees and expenses, which could be up to $25 million, including the costs of administering the settlement.

People who’ve already received a refund or have a pending request through the Florida Department of Revenue are not eligible.

How to spot a class action settlement email scam

There’s a history of scammers taking advantage of class action settlements to trick people into giving away their information or money.

Scams posing as emailed class action settlement notices often come with red flags that you can use to identify the email as suspicious or malicious, like:

- The email is vague on key details about the settled class action lawsuit

- You can’t find anything online when searching the email’s contact information

- It promises an unusually large payout

- There's pressure to act fast

- The emails include suspicious links

A real class action notice will give you details about the settled lawsuit. It will tell you who was sued and why they were sued, and it will likely tell you why or how you’ve been identified as a potential claimant.

Class action lawsuits usually involve a lot of people. That means people are more likely to get only a few dollars – not thousands – from an authentic, individual settlement, AARP says.

Typically, if you are an eligible claimant for a settlement, you have the choice to file a claim, deny your claim or ignore it entirely. If you want to file a claim, you’ll do so through a form on a settlement website.

VERIFY's Emery Winter, Brandon Lewis and Megan Loe contributed to this report.