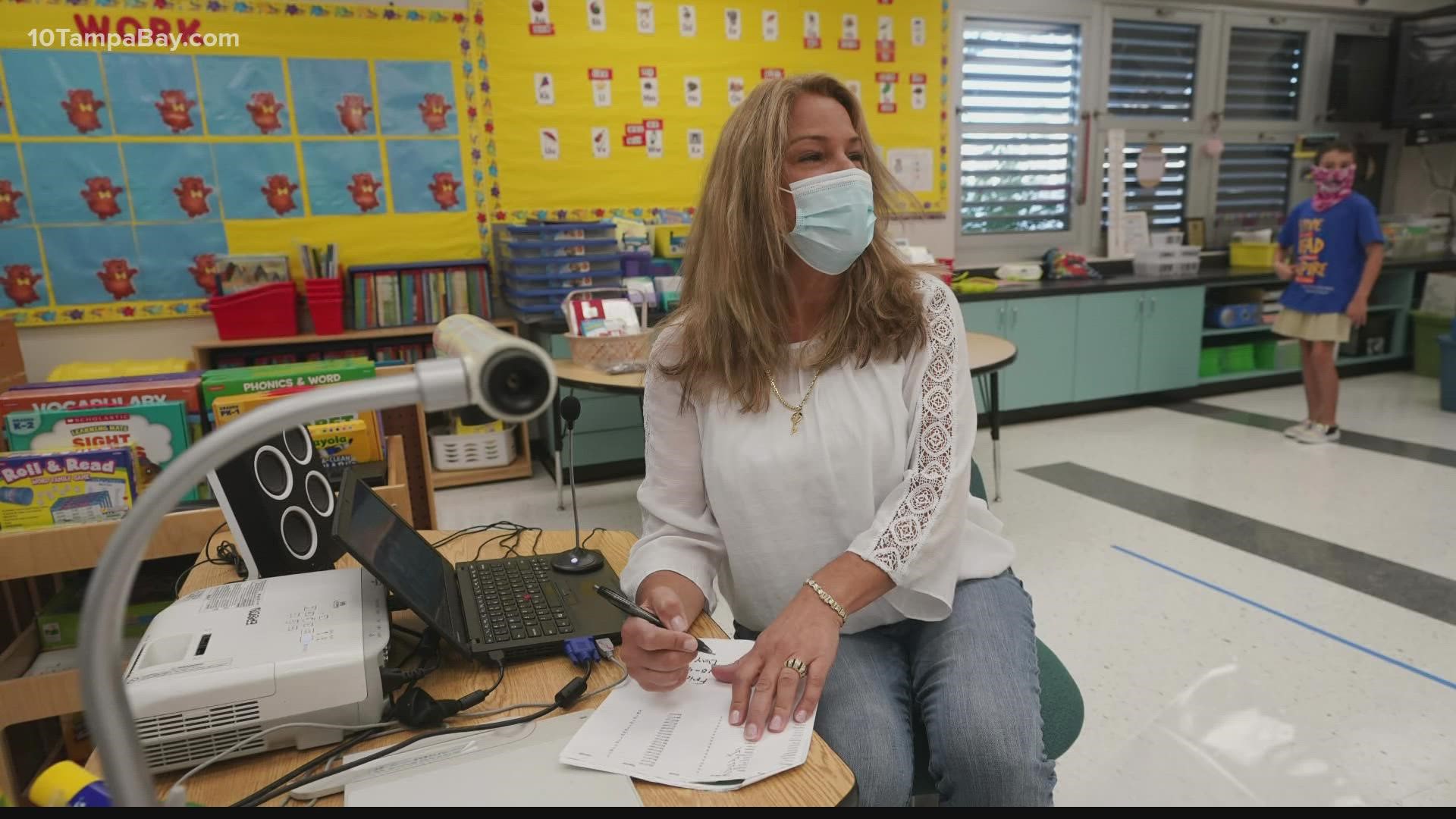

FLORIDA, USA — If you’re a qualifying teacher or first responder you should’ve received your $1,000 pandemic bonus check by now.

The pandemic payments – made possible through funds from the CARES Act – started going out in August to hundreds of thousands of teachers, principals, firefighters, police officers and other first responders.

But there’s still one question our VERIFY team continues to get: Will taxes be owed on these payments?

THE QUESTION

Will teachers, first responders owe taxes on their $1,000 COVID-19 bonuses?

THE SOURCES

THE ANSWER

No, teachers and first responders will not owe taxes on their $1,000 COVID-19 bonuses because the checks are classified as “qualified disaster relief payments,” rather than bonuses, so taxes will not be withheld, according to the state.

WHAT WE FOUND

We might not have to deal with state income tax in Florida but most of us do still owe federal taxes on bonuses and income each year.

The Florida Education Association, a union representing teachers across the state, has been advising its member to check with a financial adviser.

“We cannot stress enough the importance of keeping any correspondence that arrives with your check and the importance of discussing these funds with a tax professional,” said spokesperson Joni Branch.

But a memo to the general counsel of the Florida Department of Education says the checks could be considered qualified disaster relief payments rather than bonuses. A qualified disaster relief payment does not constitute wages subject to income tax withholding and social security tax.

A spokesperson for Florida’s Department of Economic Opportunity said the state had, in fact, designated these payments as qualified disaster relief.

The designation “allows first responders to receive the full $1,000 without employment taxes having to be withheld, which is allowable under Section 139 of the Internal Revenue Code,” spokesperson Andrew Nixon said in an email to 10 Tampa Bay.