TAMPA, Fla. — Hard to believe, but it’s tax season and even though it’s early, many of you are already prepping your documents. Unfortunately, scammers are also prepping. Some are even impersonating the IRS through voicemails, emails and texts.

People have lost millions of dollars to tax scams.

And it’s not just a financial scam, your personal information is up for grabs too.

So here’s what you need to know to keep yourself safe.

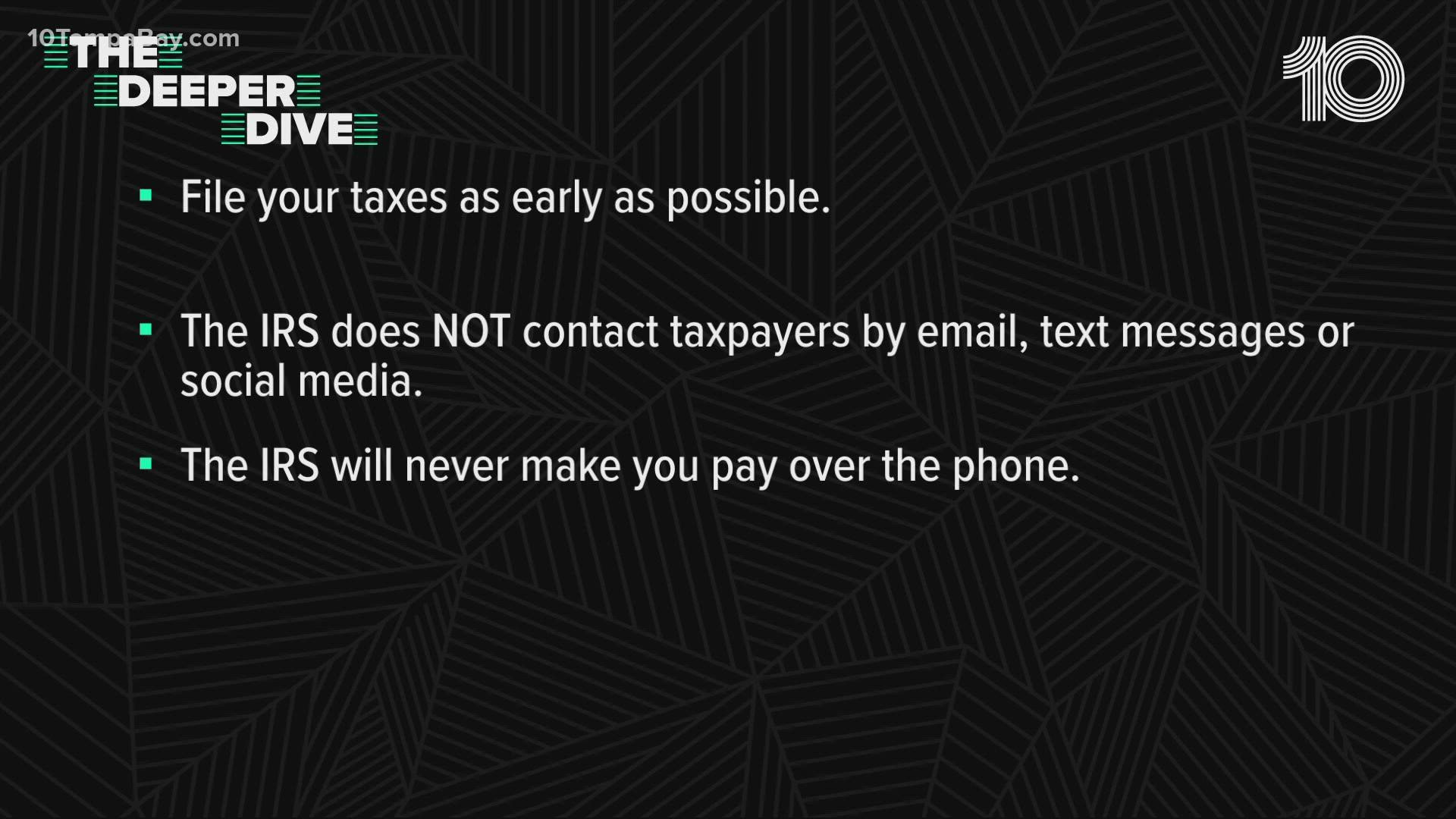

- File your taxes early.

- The IRS does not contact taxpayers by email, text messages or social media.

- If they do contact you by phone, they will never tell you that you have to pay up then and there.

“If you have questions go directly to the IRS website. Make sure you go to the correct website and you are reaching out to them and asking questions,” said Bryan Oglesby with the Better Business Bureau.

That dot-gov on the end of the web address is important. Scammers have created fake websites that may look like the real IRS site, but if you check the web address, you’ll notice it just doesn’t look right.

Here are some other useful tips from the Better Business Bureau:

The best way to avoid tax identity theft is to file your taxes as early as possible. File before a scammer has the chance to use your information to file a fake return.

In the U.S., jot down your Identity Protection PIN (IP PIN) from the IRS before you file your return. This is a six-digit number, which, in addition to your Social Security number, confirms your identity. It is important to note that you cannot opt-out once you get an IP PIN. So once you apply, you must provide the IP Pin each year when you file your federal tax returns. The IRS will provide your IP PIN online and then send you a new IP PIN each December by postal mail. Visit the IRS for more information about the program. Read BBB's tips about the IRS PIN.

Only deal with trustworthy tax preparation services. For many people, major life changes, business ownership, or simply a lack of knowledge about the ever-changing tax laws make finding a trustworthy tax preparer a good idea. That said, not all tax preparers have the same level of experience and training. See our tips for finding the right tax preparer for you.

If you are the victim of tax identity theft in the U.S., contact the IRS at 1-800-908-4490. You should also file a complaint with the Federal Trade Commission (FTC) at ftc.gov/complaint or by calling 1-877-FTC-HELP. The FTC also offers a personalized identity theft recovery plan at identitytheft.gov.

If you get tax information delivered electronically from your employer or other entity, treat that information carefully. Download it onto a password-protected computer.