BRADENTON, Fla. — More than a million people with Citizens Property Insurance will see their rates go up in the double-digit percentages over the next 12 months as Florida's “insurer of last resort” looks to find a route to being more stable.

It’s not just Citizens, Floridians across the state are feeling the pinch from the property insurance crisis, especially burdening to seniors and those on fixed incomes. One senior in the Tampa Bay area is putting pen to paper to try to push for changes.

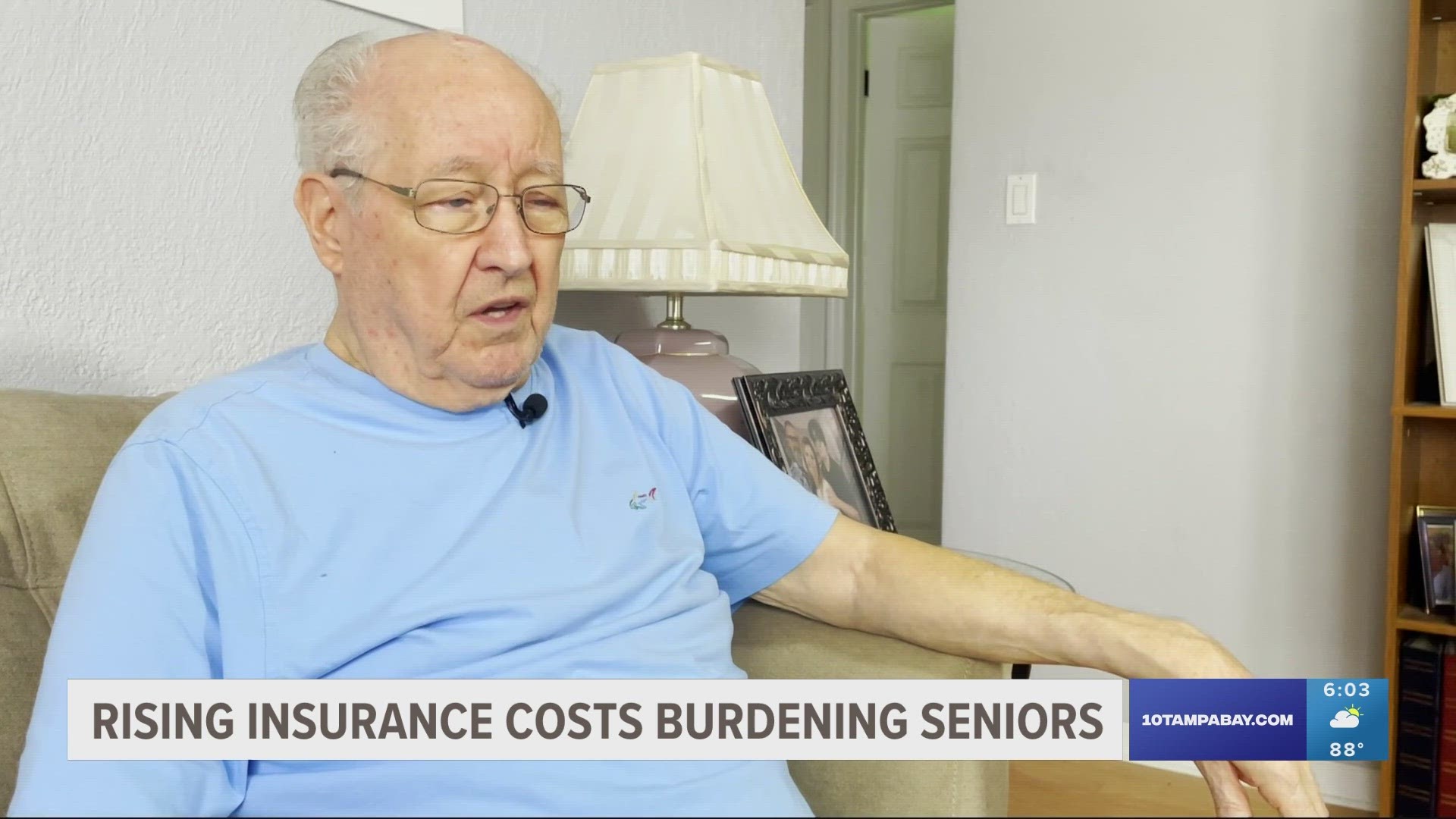

Howard Cosner and his wife Peggy live in a modest Bradenton home. He says each year the cost to insure grows out of control.

“From 2019, it's tripled,” Cosner said.

He showed 10 Tampa Bay the paperwork, from $1,260 in 2019 to his quote this year of $4,700.

“A couple thousand dollars a year is a lot, $4,000 a year here is way too much,” he added.

Especially for people like Cosner who’s in his early 80s, retired and on a fixed income. He says rising insurance costs on top of the rising cost of living are forcing them to make difficult decisions.

“The real impact when you take a homeowner on retirement fixed income. You're taking the food out of their mouth, you're taking the medicine out of their cabinet, you're just doing way too much, it's unacceptable,” Cosner explained.

He’s even written letters to the governor, state lawmakers and regulators asking them to “use their abilities to manage this in such a way that the people could afford to live here and not have to worry about this nonsense.”

Otherwise, the reality is insurance costs could force people like Cosner out of the homes and state they love.

“It's not anything that I didn't even think about doing,” he added.

The governor's office and insurance industry experts say reforms made by the legislature in recent years will eventually help wrangle costs. Though in the short term, most are still seeing their premiums rise.