TALLAHASSEE, Fla. — Ahead of a special session of the Florida Legislature to address pricy premiums and ongoing issues with the state's property insurance marketplace, a handful of companies are proposing double-digit rate increases.

The companies — including First Floridian Auto and Home Insurance Company, Florida Farm Bureau General Insurance Company and Florida Farm Bureau Casualty Insurance Company, and Kin Interinsurance Network, — have asked the Florida Office of Insurance Regulation for statewide average rate changes of at least 20 percent.

Each participated in virtual hearings Tuesday.

The proposed increases are:

- First Floridian: 22.9% homeowners multi-peril

- Florida Farm: 48.7% homeowners multi-peril

- 31.7% dwelling fire

- Kin: 25.1% homeowners multi-peril

People can participate in a public comment period by emailing ratehearings@floir.com through 5 p.m. May 31.

Unlike several companies that have dropped out of the marketplace in recent years, that's not First Floridian's intention, said Robert Aaron, a vice president with the company who spoke with WKMG-TV. However, he says the current situation is not sustainable.

Insurers say they're getting hit with lawsuits to the point many are going out of business or having to scale back.

"We do not want to non-renew, but we cannot continue forward at this unsustainable rate level," Aaron told the TV station.

State Sen. Jeff Brandes, R-Pinellas Park, has called the state's property insurance a crisis and is on the verge of collapse. Gov. Ron DeSantis previously said he would like to "bring some sanity and stabilize" the market.

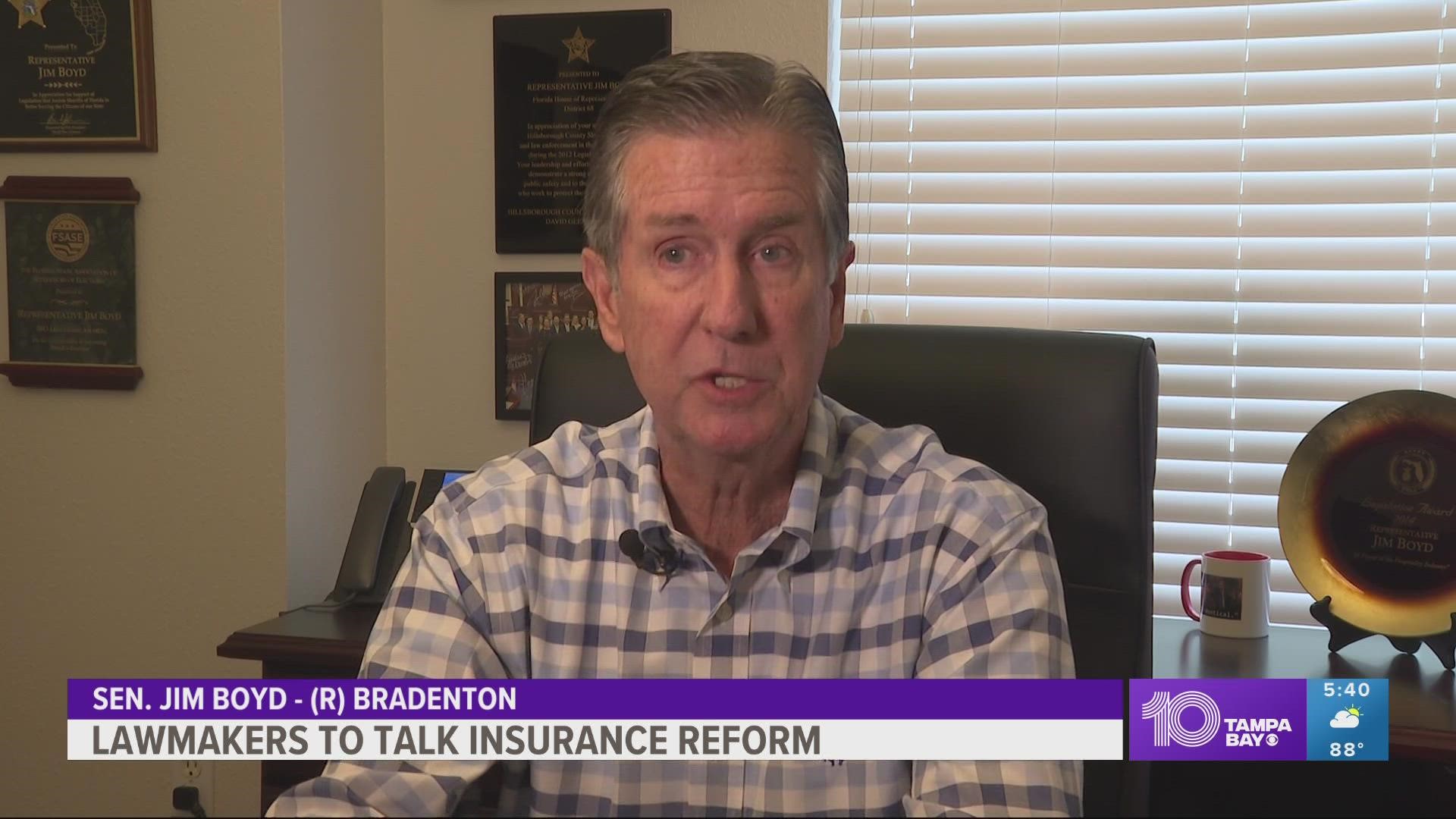

Over the last five years, 71 percent of what insurers paid out went to lawyers and 8 percent went to homeowners, State Sen. Jim Boyd, R-Bradenton, earlier told 10 Tampa Bay. That litigation contributed to the insurance market losing $1.5 billion last year.

He points to fraudulent roof claims as a factor.

A tentative schedule posted by the Florida Senate shows at least three days of meetings starting at 9 a.m. Monday, May 23.