TALLAHASSEE, Fla. — Florida regulators are now ordering the state-backed property insurance company Citizens to reduce the rate hikes they proposed.

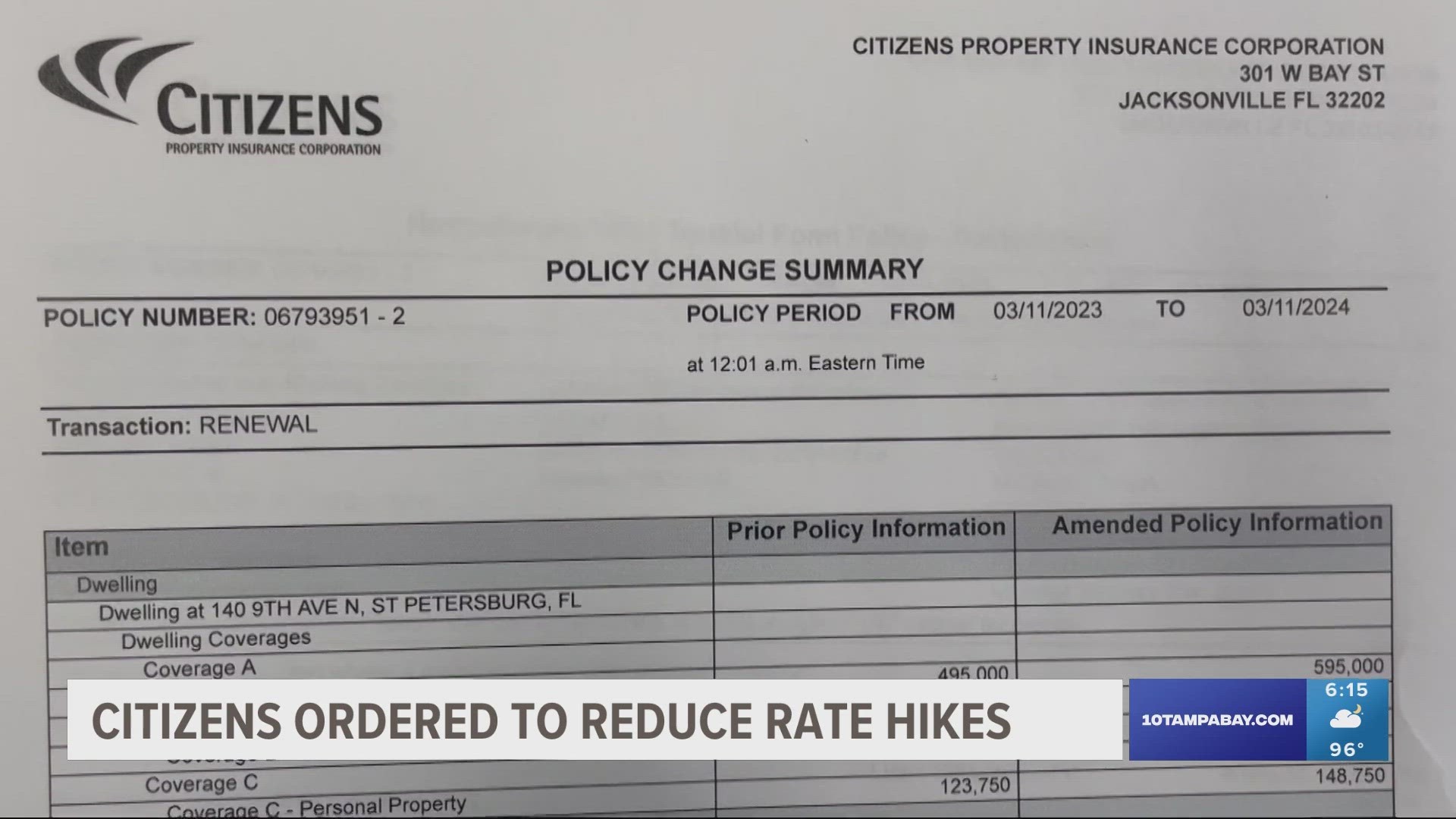

Citizens asked Florida's Office of Insurance Regulation to approve an overall rate hike of 13.3 percent, with 12 percent hikes to homeowners with "multi-peril" policies on their main homes. Citizens officials told regulators these price increases are necessary to bring their rates closer to those charged by insurance companies on the private market.

They also say the rate hike is necessary to help state leaders shift policies out of Citizens into the private market. This is something state leaders have long sought to do, at least partly because of financial risks to state backing if Florida gets hit by a major hurricane or multiple climate disasters.

According to Citizens officials, the company's lower insurance rates are undercutting the state's efforts to bring its policies into the private market.

Florida Insurance Commissioner Michael Yaworsky, however, officially contended that 12 percent is too high of a rate hike. He signed an order asking Citizens to “calculate new, reduced, overall average statewide rate increases for the rate filings."

The methods suggested by regulators would make 12 percent the maximum price increase possible for some "multi-peril" policyholders, with certain policyholders seeing no rate hikes at all. Under laws passed in 2022, policies for homes that aren't the holder's primary residence could see rate hikes of up to 50 percent.

Citizens has until Sep. 17 to submit a new proposal. Under their agreement with the Office of Insurance Regulation, their rate increases, once approved, would take effect on Dec. 9.

Less of a rate hike, could mean some cost savings for Citizens policyholders. "The good news is for policyholders, in a time where there’s not a lot of expendable cash sitting around this is a win for sure for this year. Is it an answer to the problems of the insurance market? No it is not," says Michael Sawa an Insurance Advisor with Mangrove Financial Group.

That's because the state-backed-Citizens has more than 1.3 million policies, some they are actively trying to offload to private insurers to limit their risk exposure. Experts say further limiting how much their rates can go up next year will widen the existing gap between Citizens and the private market.

"The private market is growing at 42%, Citizens is going to grow on average single digits, most likely," explains Mark Friedlander with the Insurance Information Institute. The broader gap could force more people to end up writing policies with Citizens.

"This pushes Florida closer to what we commonly refer to as a Hurricane Tax, where every consumer would be helping to replenish the funds of Citizens if they are tapped for major storm losses, which is certainly a possibility," Friedlander added.

Even if your rate doesn't go up, be prepared for your premium to increase, as your insurance cost is based on a number of factors. "Regardless if Citizens is actually allowed to increase the rate, there is still going to be a premium increase for policyholders," says Sawa. "There is still an inflation factor built in, we are seeing an average of 10% inflation for coverage limits."