TAMPA, Fla. — "Why are my premiums going up?" That's the question Citizens Property Insurance Corporation President Barry Gilway says he gets asked all the time.

According to Gilway, fraudulent claims play a huge part in driving up premiums across the state. It's why Florida's Chief Financial Officer Jimmy Patronis is "cracking down on the kind of fraud that increases all of our rates.”

Patronis held a news conference Thursday morning at the Tampa Division of Investigative and Forensic Services (DIFS) Office to announce five anti-fraud initiatives he's proposing in the upcoming special session on Florida property insurance.

“As area policyholders know, Florida’s insurance market is in trouble. We are seeing more private carriers exit the market, and we’re seeing Citizens Insurance policies grow. Governor [Ron] DeSantis has rightly called a special session to reform insurance, and lawmakers will have an opportunity to curb frivolous litigation and fight fraud," the CFO said in a statement

"Florida communities are under attack by fraudsters who are willing to try anything to game the system. They are stealing from us all! To win this war, we need the troops, the weapons, and a full commitment to the mission."

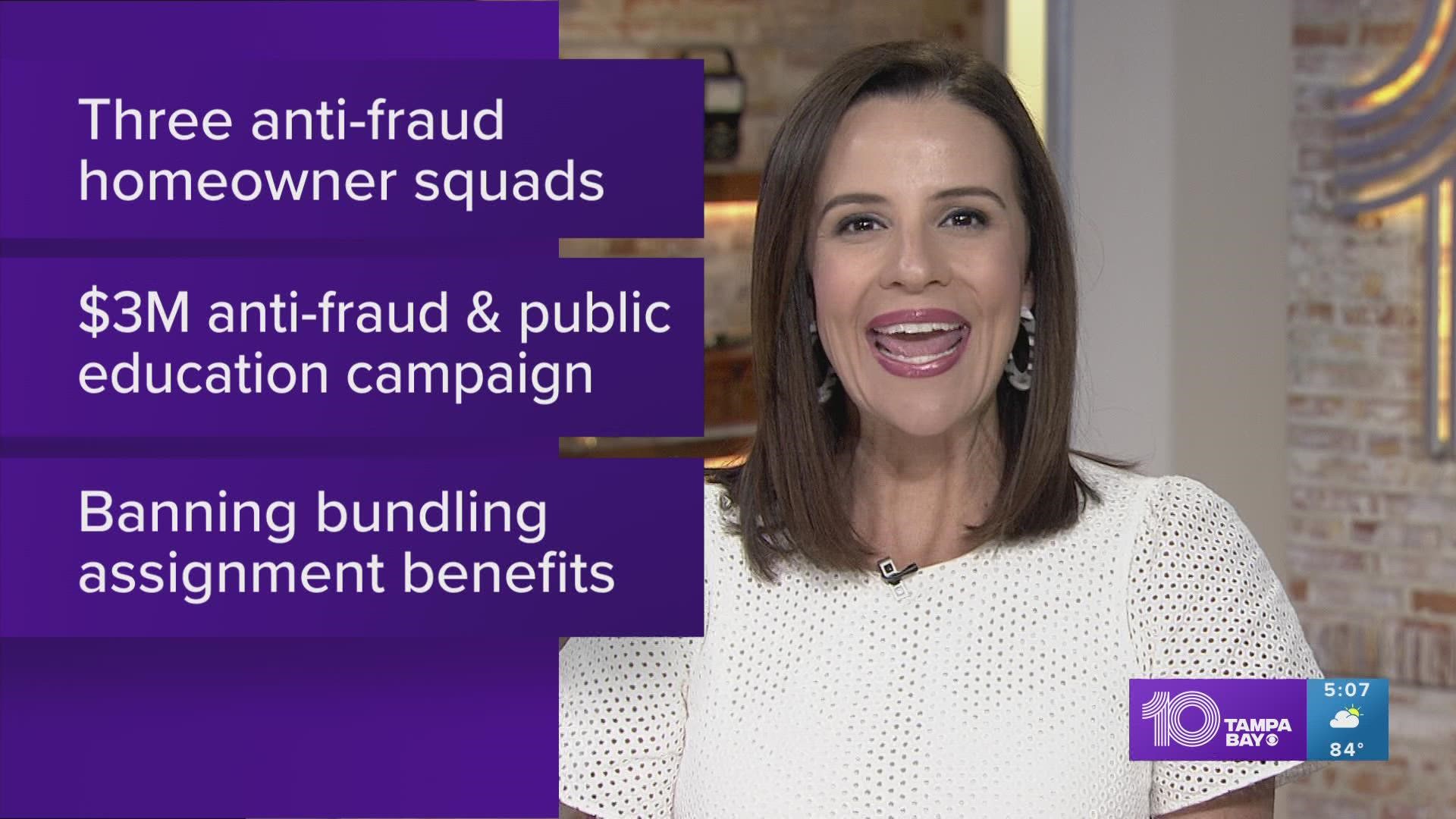

The first initiative is to set up three so-called Anti-Fraud Homeowner Squads that will "live and breathe property and casualty fraud." The goal is to place the squads in areas with a lot of fraud to hold criminals accountable and deter any future illegal activity eventually lower premiums for homeowners, Patronis explained.

The second proposal is to create a $3 million anti-fraud and public education campaign so policyholders know how to recognize signs of fraud.

The third initiative involves amending Florida’s False Claims Act to allow whistleblowers to recover damages. The CFO said this will give the public a financial incentive to report fraud.

Patronis' fourth proposal is to provide awards for all calls to the “Florida Fraud Fighter Reward” tip line, not just ones that lead to convictions.

And lastly, the fifth initiative proposes banning the bundling of AOBs (Assignment of Benefits) to deter bad actors from going after consumers.

The special session will begin at 9 a.m. on May 23 and is expected to last no longer than May 27.