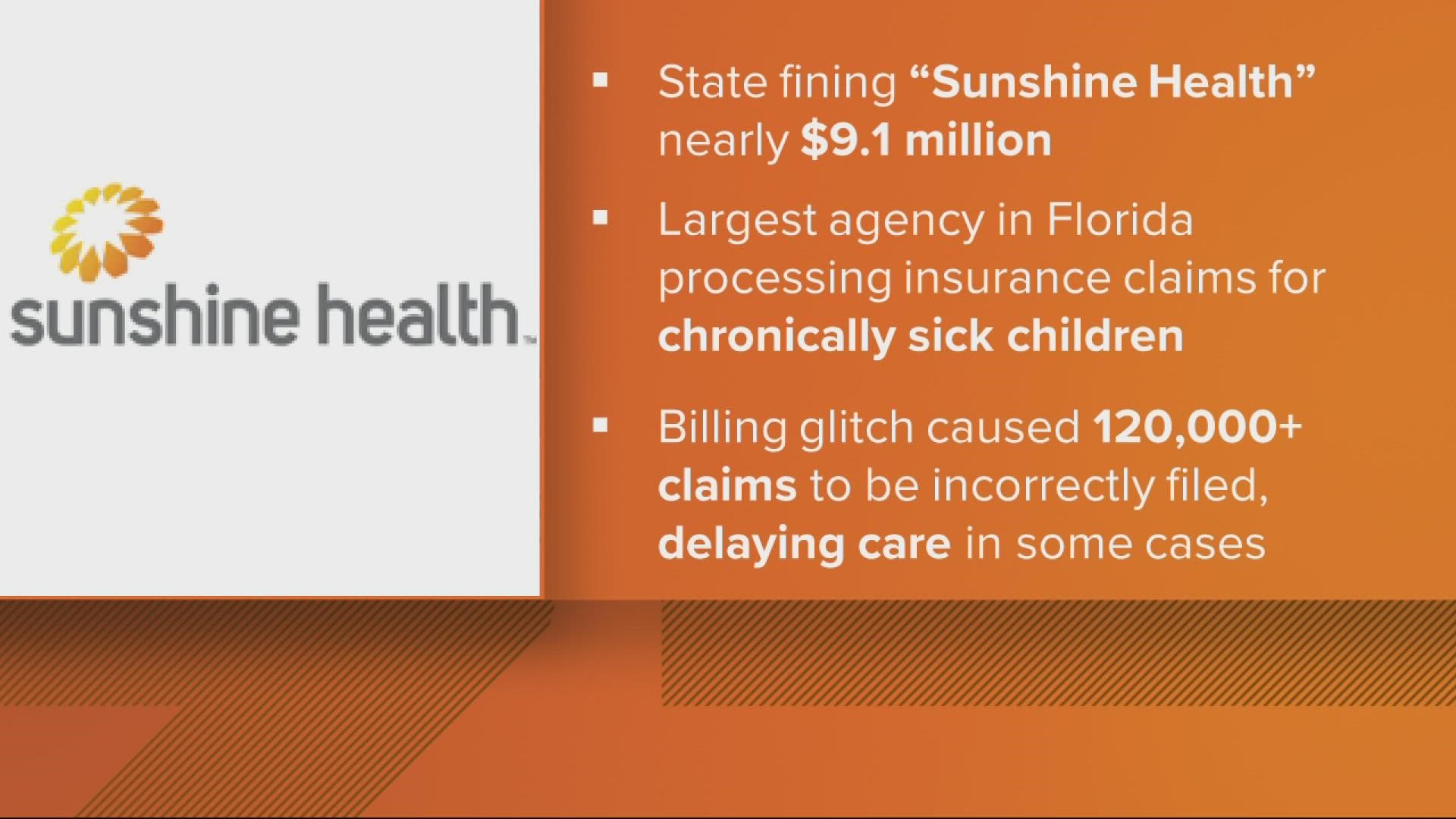

GAINESVILLE, Fla. — Florida fined its largest Medicaid payment vendor nearly $9.1 million over software problems that delayed payments for nearly three months.

The glitch impacted tens of thousands of healthcare claims for the state's sickest and neediest children, the government’s health regulator said Wednesday.

In a letter to the CEO of Sunshine State Health Plan Inc. of Tampa, the Agency for Health Care Administration also demanded detailed explanations for how the problems occurred and how the company responded.

It also required the company to demonstrate within 30 days that future claims were being paid promptly and asked for weekly updates in phone calls with the CEO, Nathan Landsbaum, or another senior executive.

The payment problems left families in Florida with critically ill children who relied on Medicaid-paid health providers stranded. Children affected were those receiving care under the company’s Sunshine Health Medicaid program and the Children’s Medical Services Health Plan it operates on behalf of the Florida Department of Health, for patients under 21 who are eligible for Medicaid and who have serious, chronic conditions.

A spokeswoman for Sunshine State did not immediately respond to a phone message or emails asking whether the company intended to pay the $9,092,025 fine or planned to appeal. The state said the fine was calculated as $75 for each failed payment claim.

The state’s healthcare regulator also revealed that the number of affected claims – 121,227 – was far higher than Sunshine State had previously acknowledged. The company had previously said the problems affected one-half of 1% of its 9.2 million total payment claims it processed during the period, or about 46,000 claims.

The state identified problems that included denials for invalid diagnosis codes, incorrect age restrictions, claims processed under incorrect benefit packages and more.

Sunshine State previously said the glitches stemmed from the company's merger on Oct. 1 with the second-largest payment vendor, WellCare of Florida Inc. Combined, Sunshine and Wellcare have multi-year contracts worth $31.6 billion from the state's AHCA, according to figures from the state’s chief financial officer.

The billing problems were described in an investigative report last month by Fresh Take Florida, a news service at the University of Florida College of Journalism and Communications. The state’s letter informing Sunshine State about the fine was dated March 17 – one day before a reporter’s latest inquiries about whether the company would be fined – but was not released publicly until Wednesday.

Before then, the payment problems drew almost no public attention. Sunshine acknowledged payment issues in a Jan. 20 press release, blaming an unspecified information-technology problem and not hinting at the scale or seriousness of the issue.

The payment problems were among the most serious technology meltdowns – affecting one of the most vulnerable populations – under the administration of Gov. Ron DeSantis since unemployment claims overwhelmed Florida's Department of Economic Opportunity early in the pandemic.

The AHCA in its letter acknowledged that Sunshine State’s billing problems were “non-willful.” The letter, signed by Florida’s assistant deputy secretary for Medicaid operations, Brian Meyer, also provided the company with instructions on how to dispute the fine, which would have to take place within 21 days.

The company said last month the improperly rejected payments were all re-processed by Jan. 31, but new interviews with healthcare providers demonstrated payment problems have persisted. In at least one case, a company in Orlando was asked to “stay quiet” before Sunshine State would agree to pay part of the money it already owed the provider, an executive said.

Brendan Ramirez, a mental health advocate and CEO of Pan American Behavioral Health Services LLC in Orlando, said he had spent months trying to recover payments he was owed from Sunshine State.

Ramirez said that during negotiations over the payments, Sunshine State’s parent company, Centene Corp., asked him to sign a non-disclosure agreement before he could receive $234,225.90 of what he said he was owed. He provided a copy of the agreement, which he declined to sign. Ramirez said the amount Centene offered was less than the total he should have been paid.

“They said, 'Before we wire money into your account, we want you to sign this document,'” Ramirez said.

The agreement would have prohibited Ramirez from publicly disclosing terms of his settlement with Centene for the payment. It did not include any provision that would have prevented Ramirez from criticizing the company or talking to journalists.

“I called them back and I said, 'I'm not signing this. I'm not comfortable with signing this. It's almost like a document from litigation, and we're not in litigation. I'm just trying to get money that you guys owe me,'” he said.

Ramirez said the company eventually paid him without a signed copy of the agreement. He said he is still owed as much as $80,000 by the company. He said Centene also has improperly denied about $100,000 more worth of claims submitted by his company.

Centene’s stock price closed at $82.46, down nearly 6% on Wednesday. Other healthcare companies also were trading lower Wednesday.

–––

This story was produced by Fresh Take Florida, a news service of the University of Florida College of Journalism and Communications. The reporter can be reached at kristin.bausch@freshtakeflorida.com.