TAMPA, Florida — On Thursday, the chairman of the Senate Budget Committee launched an investigation into Citizens Property Insurance — Florida's insurer of last resort.

Citizens' market share in Florida has more than doubled since 2020 and is only expected to continue growing as private insurers in the state continue to go insolvent or exit Florida altogether. Because of this, the committee says it's concerned that if Citizens is unable to cover its losses, it might ask the federal government for a bailout.

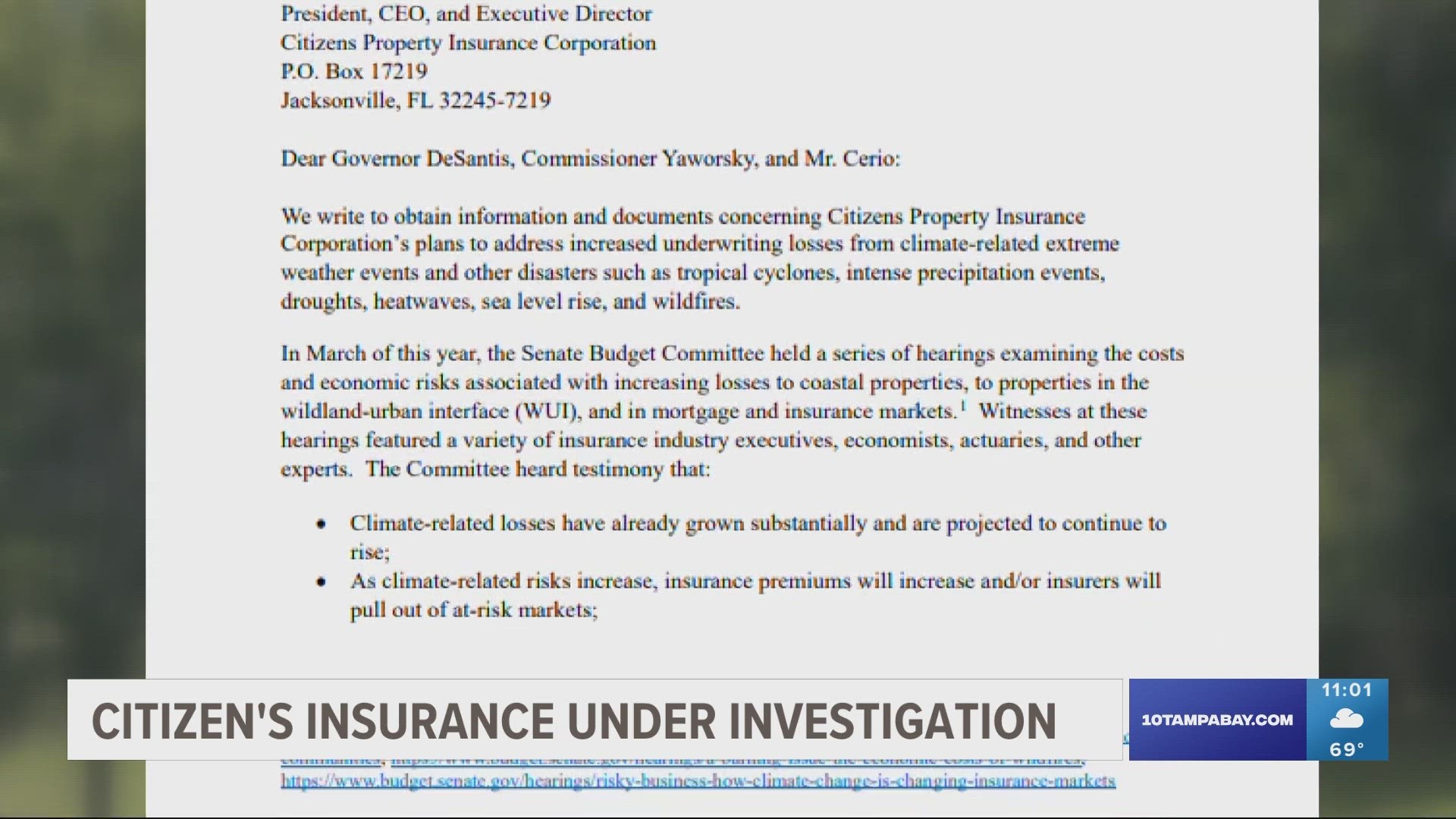

“The Committee is … increasingly concerned about Florida’s uniquely large and growing exposure to climate-related property losses, Citizens’ rapidly expanding market share, and state law allowing Citizens to levy special assessments on all policyholders in the event that losses exceed its ability to pay," Chairman Sen. Sheldon Whitehouse (D-RI) said in a letter from the Senate Budget Committee.

According to Whitehouse, a bailout request would put the government and American taxpayers at "substantial risk."

The letter also mentions that Gov. Ron DeSantis himself acknowledged that Citizens would likely be unable to pay out claims if Florida were hit by a large hurricane.

Under the investigation, the committee is asking Citizens for documents that detail the insurer's plan to address increased underwriting losses from extreme weather events like droughts, heatwaves and sea level rise. It has also requested information related to:

- Citizens' current assets

- The maximum total claims Citizens would be able to pay without having to levy an assessment on Florida policyholders

- Any communications Citizens may have had with DeSantis about its future solvency

- If Citizens has considered asking for a federal bailout

According to the Senate committee, this investigation comes amid a larger probe into the insurance industry's response to climate change and potential economy-wide harms from widespread uninsurability.

The committee has requested that Citizens provide the documents by Dec. 21, 2023.