ST. PETERSBURG, Fla. — Governor DeSantis is laying it bare, saying the Citizens Property Insurance Corporation “is not solvent,” meaning it could go bankrupt if a major hurricane hits Florida again.

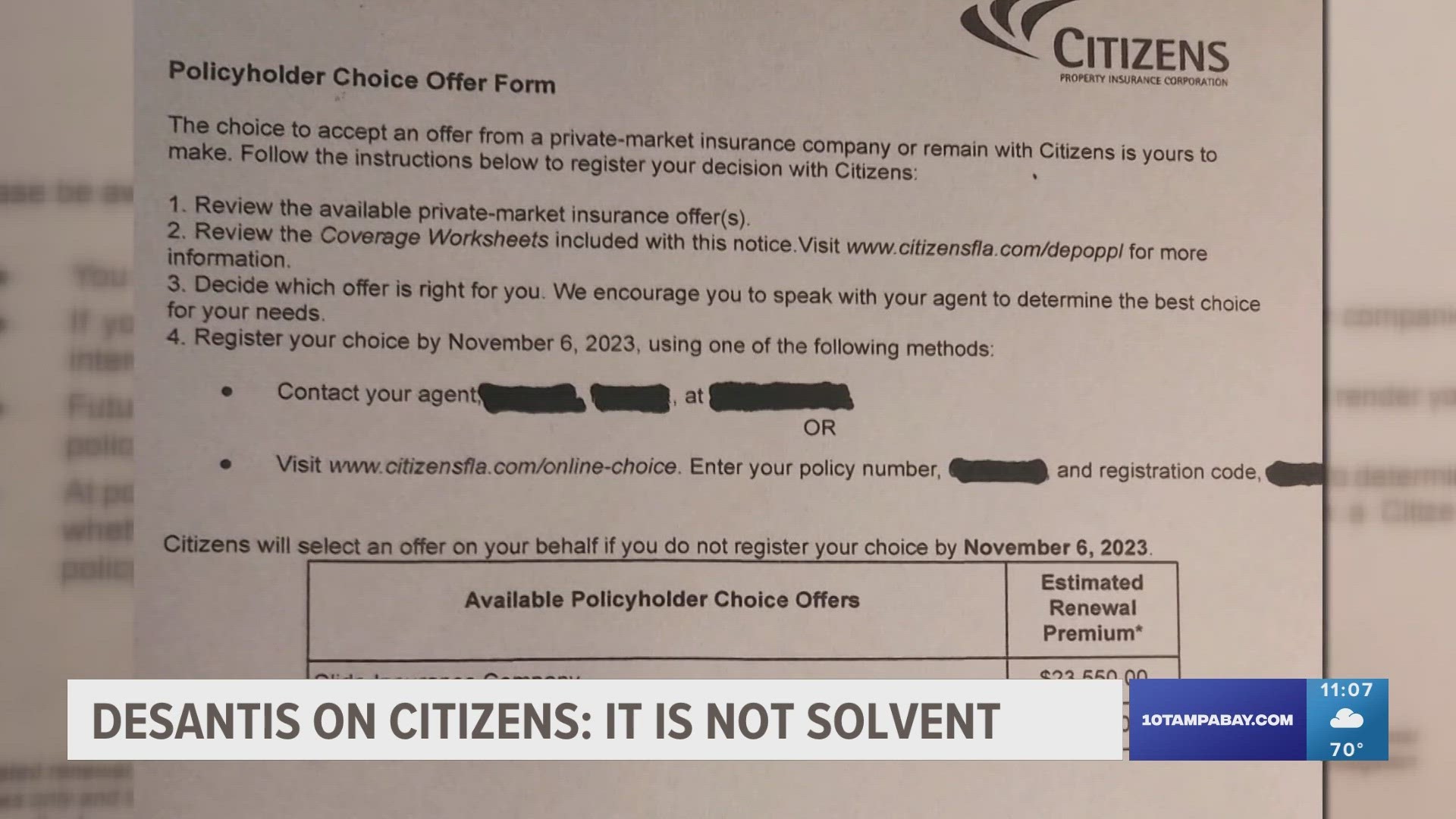

Remember, the state's main goal to stabilize the home insurance market is for Citizens to shed hundreds of thousands of policies and pass them off to private insurers.

The good news is, that is happening. But if a major hurricane were to hit Florida again and Citizens ran out of money — all of us would be paying more to prevent its bankruptcy.

“We can't have millions of people on that because if a storm hits, it's going to cause problems for the state,” DeSantis said during an appearance Tuesday night on CNBC. “There's a general inflation that is impacting this. It's much more expensive for a roof than it was four or five years ago, that's just a reality.”

It's unlikely Florida would ask Uncle Sam for a federal bailout because a state law would require all home policyholders to pay a special assessment up to 45% of their premium.

Last year, Citizens CEO Tim Cerio responded to a demand for answers from the U.S. Senate Banking Committee and its chairman, Sen. Sheldon Whitehouse (D- Rhode Island,) which launched an investigation into Citizens and its fiscal viability.

Specifically addressing concerns from Washington that Florida would ask for bailout money to support Citizens in a catastrophe, Cerio wrote:

“As Florida’s insurer of last resort, Citizens is structured so that it will always be able to protect its policyholders and pay claims. Citizens purchases adequate levels of reinsurance to cover its losses, has ample reserves, has various financing tools at its disposal, and the State of Florida has a strong fiscal position given the state’s continued economic growth and record net in-migration.

Importantly, if Citizens were to pay out all reserves and reinsurance following a major storm or series of disasters and there is a deficit, then depending on the extent of the deficit, Citizens would be required by Florida law to levy surcharges on its policyholders and assessments on other Florida insurance consumers until the deficit is eliminated.”

Jake Holehouse is an insurance broker in St. Petersburg and says there are some positive signs the insurance market in Florida is stabilizing. Rate increases are expected to level off and Citizens has reduced its policy count by about ten percent over the past year.

“If you get a Hurricane Ian and it hits the east coast instead of the west coast, we could have a day of reckoning for the state of Florida and the financial viability of the Citizens model,” Holehouse said. “What we're seeing is that carriers are saying, ‘Hey, we want to take more risk in Florida, hey please starting writing more with us,’ whereas for the past 3 to 5 years it's been, ‘How do we continue to shed policies, how do we make our footprint in Florida smaller.’"

There's also legislation in Tallahassee that's not getting much attention but could seriously impact second-home policies. It would allow for surplus line insurers to take over tens of thousands of second-home policies from Citizens.

Supporters say it continues shrinking the total number of Citizens policies and that's a good thing. Opponents worry the surplus line insurers are far less regulated than typical insurers and don't have to get approval from the state for rate increases.