TAMPA, Fla. — If you're looking to stock up on fresh supplies for the quickly-approaching school year, the next two weeks are the time to do it.

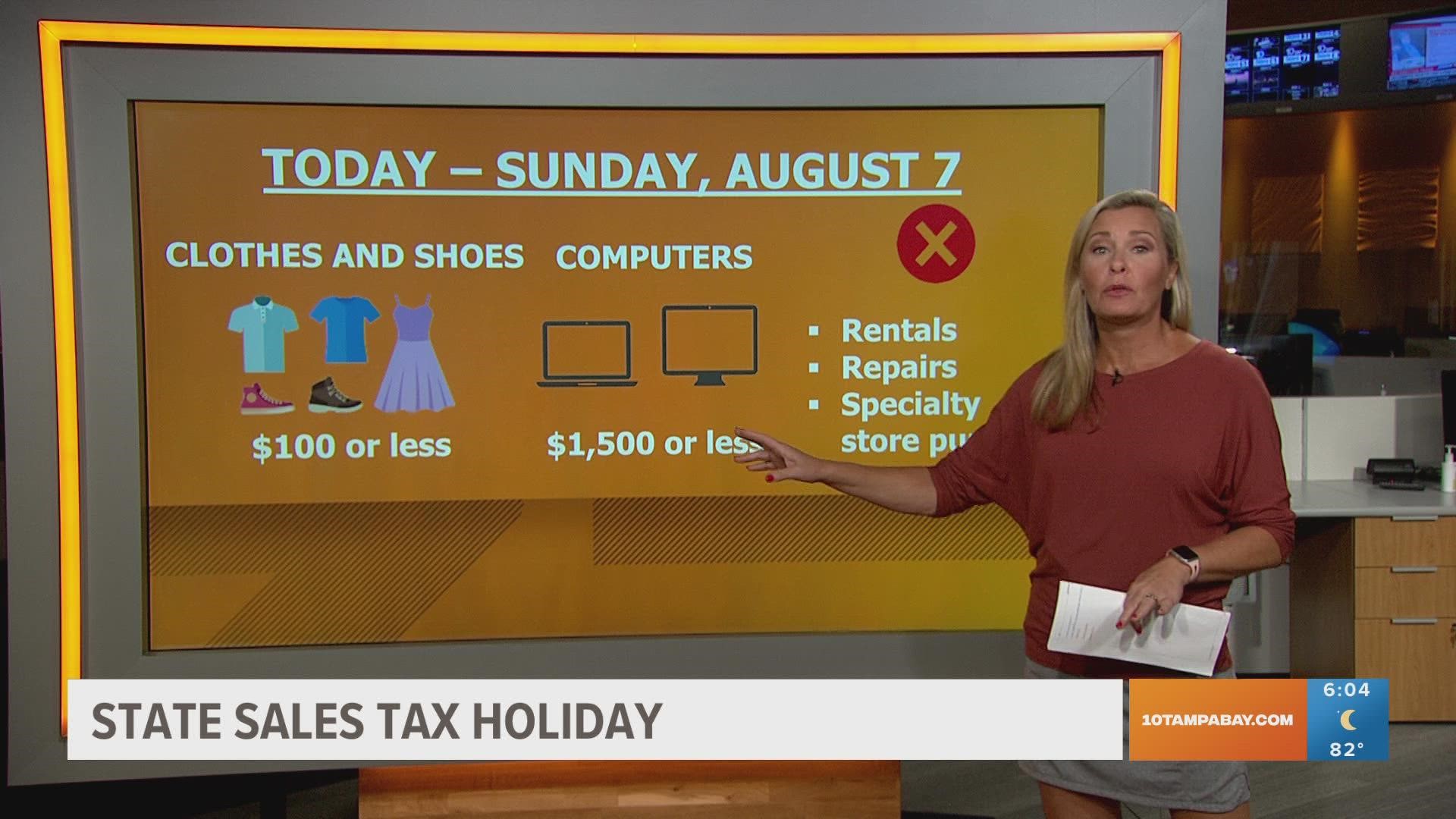

Florida's 2022 Back-to-School Sales Tax Holiday runs from Monday, July 25, to Sunday, Aug. 7.

Here's a guide to which back-to-school items will be exempt from sales tax.

There are four main categories to help guide you on your shopping journey this year:

- School supplies selling for $50 or less

- Clothing, footwear and accessories selling for $100 or less

- Learning aids and jigsaw puzzles selling for $30 or less

- Computers and accessories (when purchased for non-commercial and personal use) selling for $1,500 or less

Examples of exempt school supply items

- Binders

- Calculators

- Composition books

- Crayons

- Folders

- Lunch boxes

- Pens, including felt, ballpoint, fountain, highlighters, and refills

- Scissors

- Notebooks

- Staplers and staples (used to secure paper products)

Examples of exempt clothing and accessories

- Athletic supporters

- Baby clothes

- Backpacks and book bags

- Bicycle helmets

- Bathing suits

- Bras

- Cleats

- Dresses

- Graduation gowns and caps

- Hair clips, barrettes, elastics

- Leotards

- Martial arts attire

- Raincoats, rain hats and ponchos

- Uniforms (work, school, and athletic)

- Sleepwear (nightgowns and pajamas)

- Socks

- Pants

Examples of learning aids

- E-books

- Flashcards

- Jigsaw puzzles

- Matching games

- Puzzle books

- Search-and-find books

- Toys that teach reading or math skills

Examples of exempt computers and computer-related accessories

- Cables

- Computers for noncommercial home or personal use (Desktop, laptop, tablet)

- Docking stations

- Flash drives

- Hard drives

- Headphones

- Ink catridges

- Jump drives

- Memory cards

- Microphones used for computers

- Printer cartridges

- Software

- Speakers

- Web cameras

- Tablets & e-readers