JACKSONVILLE, Fla. — Gov. Ron DeSantis will call another special session of the Florida Legislature in May to address ongoing issues with the state's property insurance marketplace.

The governor announced Monday that he will sign a proclamation this week detailing when the session would begin. It's likely to come as lawmakers are meeting during a special session on congressional redistricting, which recently involved the governor vetoing the state legislature-backed map.

State Sen. Jeff Brandes, R-Pinellas Park, has called the state's property insurance a crisis and is on the verge of collapse. DeSantis said he would like to "bring some sanity and stabilize" the market.

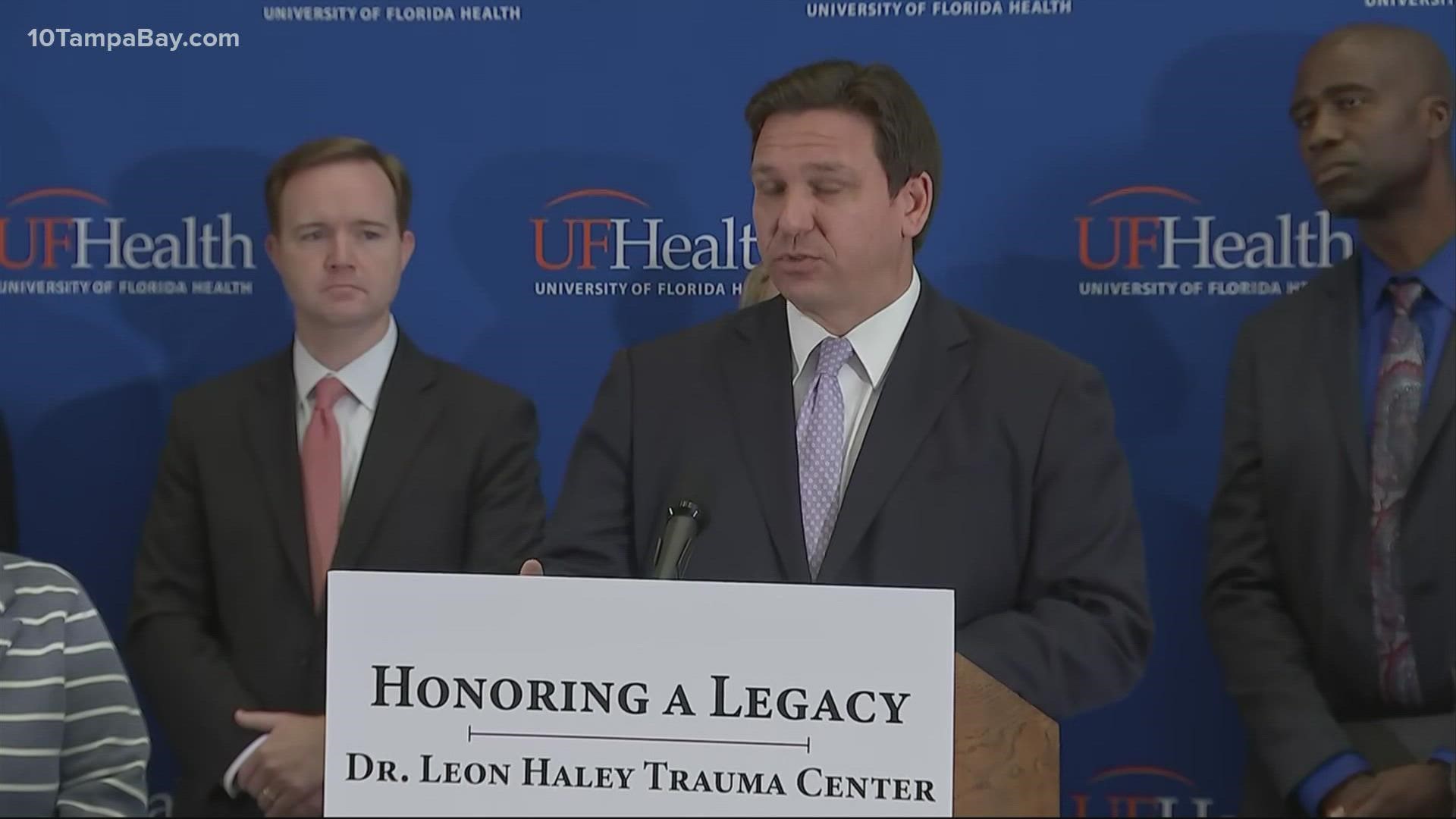

"What I will be signing this week is a proclamation to set the dates for a special session in May," DeSantis said. "We're going to work with the legislative leaders on those dates, and it will have as the main focus of the reform of the property insurance market.

"We may also address other issues that came close to getting across the finish line that maybe we can tweak and get there and once we have an agreement on that, I'll be announcing that as an addition, as well."

Brandes earlier made the request for a special session, especially for it to happen before hurricane season arrives. He says lawmakers will likely tackle three key issues during the session:

- Florida's Hurricane Catastrophe Fund — lower reinsurance rates so it won't be too expensive for insurers. Lowering rates there would lower how much people pay.

- Private property insurance market — bolster it so people can price their policies to their wallets and have more insurance options.

- Fix Citizen's Property Insurance — make sure the state's insurer of last resort isn't taking on too many homeowners. That way they'll be able to pay out claims when they're filed.

The problems that come along with property insurance aren't new to Floridians who have been vocalizing worries.

Rates are getting too high, and more companies are dropping out of Florida.

"This neighborhood and my house has slowly increased in value over the years," said Pete Olivares, a homeowner in St. Petersburg's Old South East Neighborhood in an earlier interview. "I've seen increases – $200, you know, $150 – which were reasonable, but never anything like this."