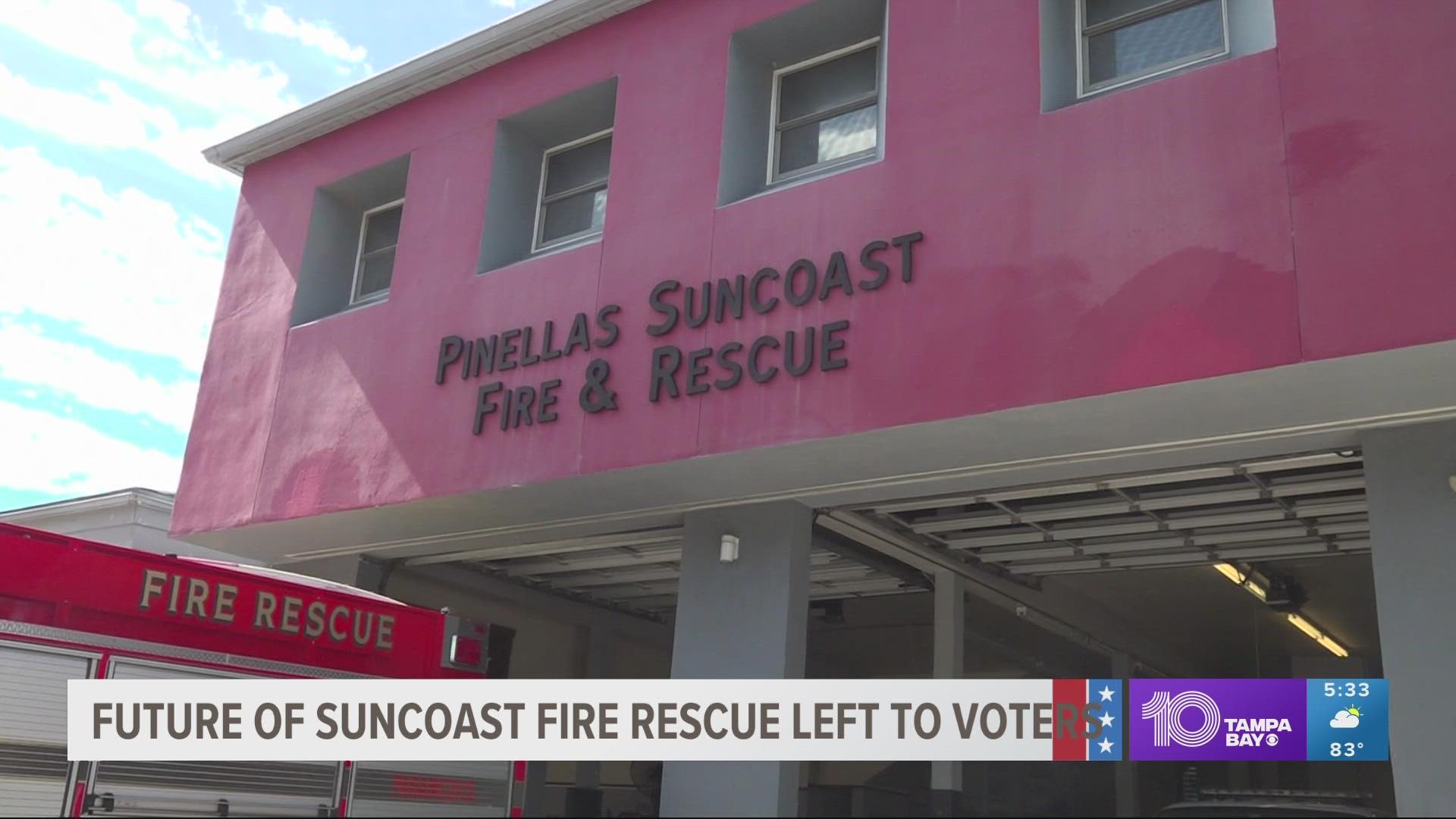

PINELLAS COUNTY, Fla. — Pinellas Suncoast Fire & Rescue is hoping voters will push through a 0.67 mills ad-valorem tax increase on Nov. 8, so they can continue to operate.

“Our reserve levels or our savings account is at critically low level," Chief Jeffrey Davidson said. "So that's one of the most important things we need to do is get that to the state mandated reserve level, which is 17%."

The department serves from Bellair Shore to Indian Shores, and they say they need more money to keep up with the growing population.

"The call volume, year after year for this area, we've gone up over 10% every year," Davidson said. "Our mainland station, the call volume there went up last year, went up 33%."

The increase would mean that homeowners would pay an additional $67 for every $100,000 of taxable value for their home. Indian Rocks Beach mayor Joanne "Cookie" Kennedy says the proposal has her full support.

"Whatever we have to do to help our fire district and our firemen, I'm standing with them, and I know many residents who are too," Kennedy said.

But not everyone is on board. David Gardella the fire commissioner for Bellair Beach cast the lone vote against putting it on the ballot. In a statement to 10 Tampa Bay he explained his reasoning.

"I just feel there is another way to generate the funds needed by the district without adding an Ad-Valorem tax of .67 which the district has never had. You and I both know that once that tax is added it will never be removed," he said, in part.

Gardella instead suggested, "as a Special District in the State of Florida we can ask the property owners/voters to vote on and approve a special assessment for capital improvements (new fire stations, equipment etc) when needed. I ask that we consider that option as early as next year instead of adding another line to the Ad Valorem section of our tax bill which will be on our future tax bills forever."

However, Chief Davidson says it’s imperative in keeping the area safe, both by land and by sea.

"I believe last year alone, well over 130 calls for water rescues," he said. "So we're the busiest marine unit in the entire county."

Davidson said they just want to even the playing field.

"We're the only professional firefighting organization in the entire state that does not have an ad valorem tax," he said. "And out of the 18 fire departments in Pinellas County, we're the only one who does not have an ad valorem tax."

But Commissioner Gardella says there's a good reason for that.

"The value of the land so much more than other areas, and there shouldn't be a need to pay fire tax on that type of value once it's factored in with the ad valorem instead of just a flat assessment," Gardella said.

He added that he agreed with Davidson and others that there's a need for improvements on fire stations and equipment, just not the approach.

"The chief is a great guy, hard worker, and the proposals in the capital improvement plan that we have in place for the next several years is in fact, needed for the district. No question. I just would like to see us generate the funds to do that other than the ad valorem tax, we have other options," Gardella said.

Chief Davidson is urging voters to remember that if the 0.67% mills increase were voted through, it wouldn't change year-to-year.

"It's not on your home's value necessarily, it's on your taxable value. But that zero-67 cannot be raised by us," he explained.

Davidson said this is a matter of keeping the district safe both on land, and out on the water.

"I believe last year alone, well over 130 calls for water rescues," he added. "So we're the busiest marine unit in the entire county."