ST. PETERSBURG, Fla. — For most taxpayers, if you haven't yet filed your 2021 tax return, you have less than a day to figure it out.

But what if you submitted your tax return and you received a message that said your return has already been received?

According to the U.S. Treasury, the IRS found 442,991 fraudulent tax returns as a result of identity fraud in 2019. The fraudulent activity kept away $1.87 billion in refunds from Americans.

Tax-related identity theft happens when someone uses your stolen personal information, like your Social Security number, to file a tax return claiming a fraudulent refund, the IRS says. If you think you are a victim of identity theft, the IRS says you should continue paying your taxes and file your tax return anyway — even if that means you'll have to file a paper return.

Here are a few signs of tax-related identity theft:

- You receive a letter from the IRS about a suspicious tax return you did not file

- You're unable to e-file your tax returns due to a duplicate Social Security number

- You receive a tax transcript in the mail you did not request

Click here for a full list.

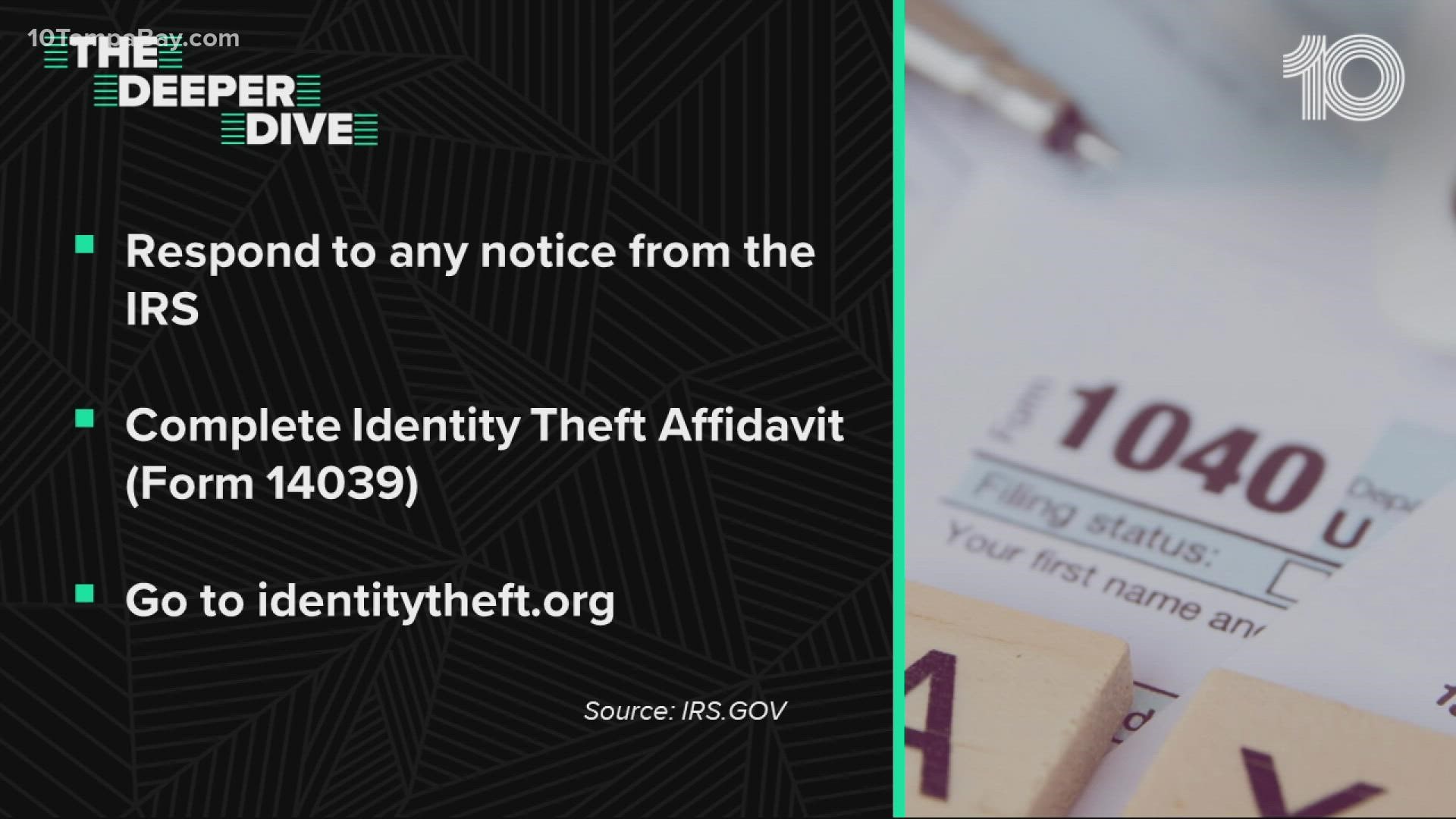

If you think your Social Security number is compromised and you are suspect of tax-related identity theft, the IRS has a list of recommendations to get you in the clear.

Most importantly, if you believe a fraudulent return has been filed in your name, you can get a copy of the return by request.

If you have filed your tax return and are waiting for your refund, you can track the status of your e-file or paper tax return through the IRS.