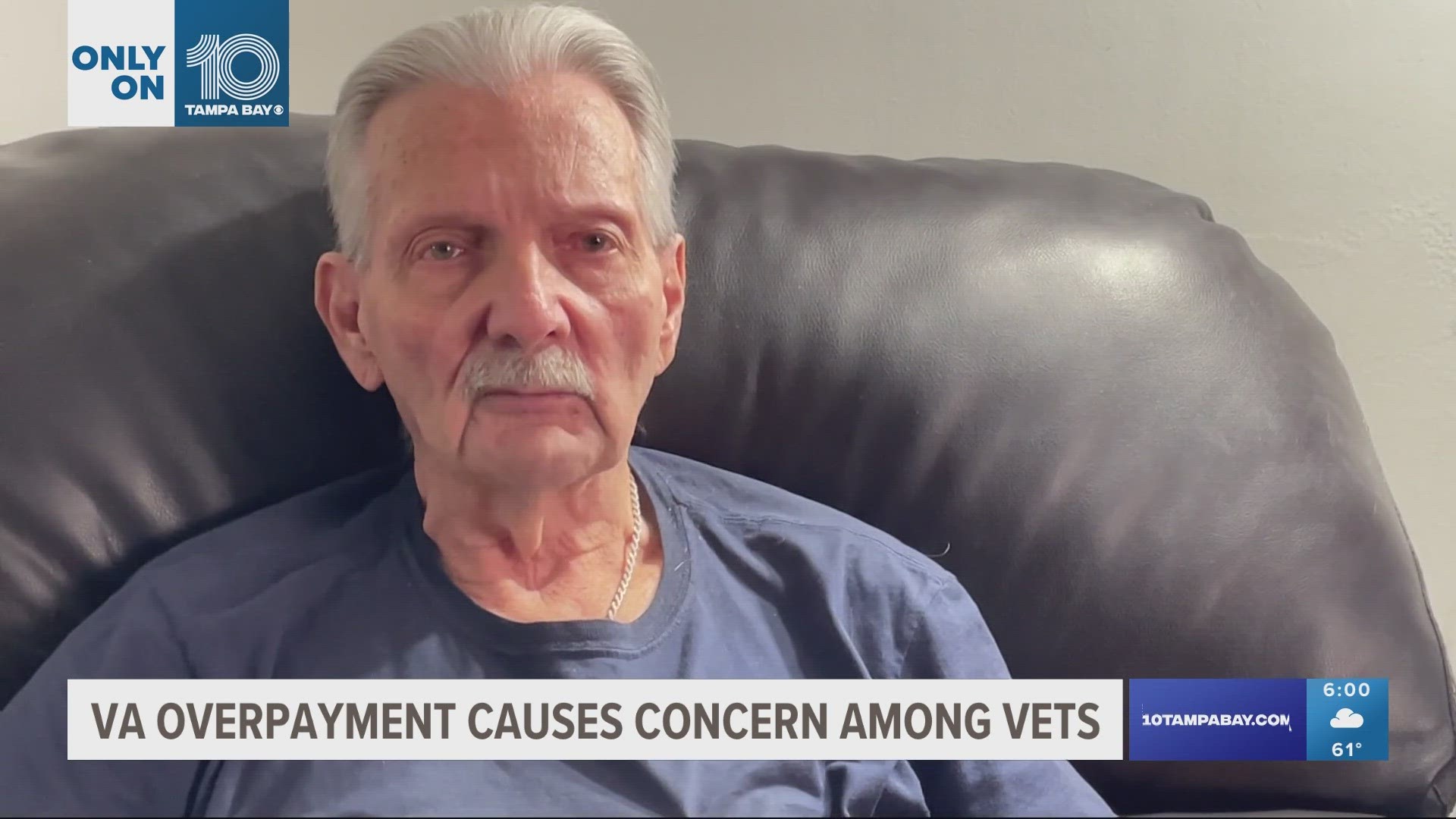

LARGO, Fla. — On the wall of his Largo apartment are mementos of Richard Pierce’s time in service.

Photos from boot camp, medals, discharge papers and more.

“I was an 0311, I was a combat Marine, I was a grunt,” Pierce explained.

The proud U.S. Marine fought in Vietnam in the late 1960s, and like many others, he came back with more than just medals.

“I always had back problems and PTSD coming back from service, which they are just now recognizing,” Pierce added.

The 74-year-old says nowadays his income all comes from U.S. Department of Veterans Affairs pension payments and social security, which he started collecting 12 years ago.

“I barely make it now, after I pay my bills and my rent and everything,” Pierce said.

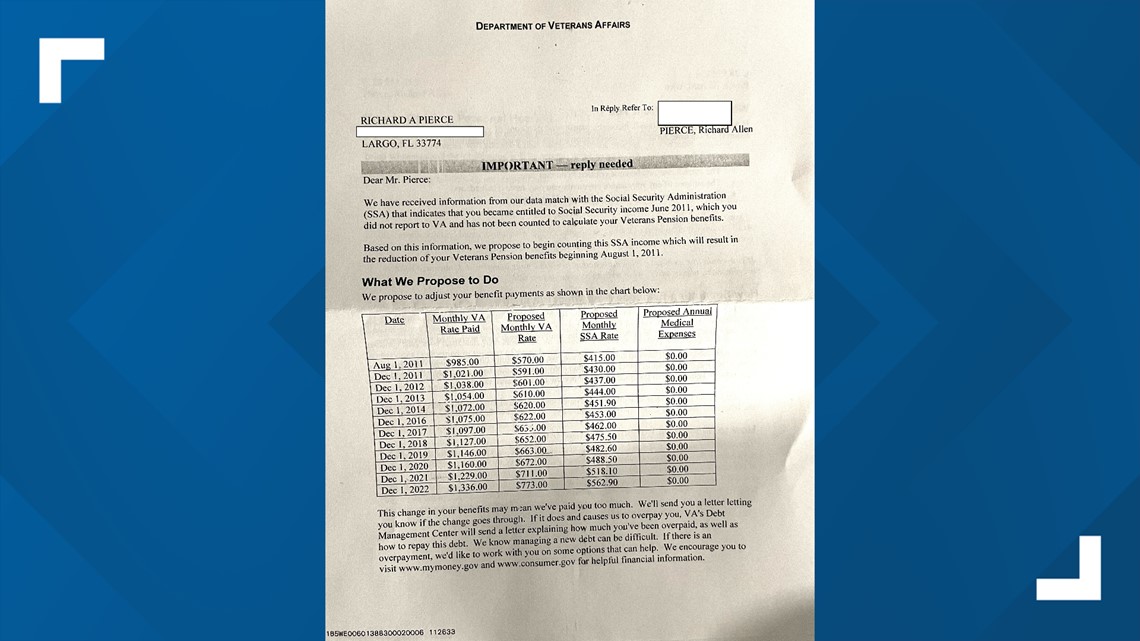

To add to it, Pierce got a letter from the department a few weeks ago saying his pension will be reduced, backdating to 2011.

“I did all the math work and it's roughly $63,000 they are saying I owe them,” Pierce said.

The VA provides pension payments to wartime veterans of low income, which are based on self-reported income level.

Pierce is likely one of 30,000 veterans to be overpaid pension by the VA but not yet have debt established by the department. Nearly 10,000 others received notification recently that they accrued a debt and needed to pay it back, after an issue with data matching dating back years.

In a statement, VA Press Secretary Terrence Hayes tells 10 Tampa Bay that for 11 years, an issue didn’t allow the department to verify the income of veterans.

“Between 2011 and 2022, due to discrepancies in data matching, VA was unable to reliably verify the self-reported federal income of Veterans and survivors receiving pensions,” Hayes said in a statement. "When income verification resumed in July 2022, roughly 9,900 beneficiaries were determined to have higher income levels than self-reported.

"This resulted in VA pension overpayments which – in some cases – spanned many years."

In addition to self-reporting, the department says veterans have to “traditionally verify the self-reported income using data matching.”

“It is a failure, it's a glitch in their system. We didn't take money purposely,” Pierce added.

During a lively hearing on Capitol Hill, VA officials took responsibility for the issue that caused debt to rack up for thousands of veterans.

“We take full responsibility for the issues with that computer match,” said Paul Shute, assistant deputy undersecretary for the Office of Automated Benefits Delivery for the department.

Officials were questioned under oath by House lawmakers on the Veterans Affairs Technology Modernization subcommittee, some highlighting 10 Tampa Bay’s first report on the problem.

“We saw an article from a Florida man, a veteran who received notification he was in debt $100k,” said Rep. Sheila Cherfilus-McCormick, D-Florida.

While the VA has paused debt collection and establishment for now, they say they are looking at ways where that debt wouldn’t fall on veterans’ shoulders in the future.

“What exactly needs to happen for Secretary [Denis] McDonough to erase those debts?” questioned Subcommittee Chairman Rep. Matt Rosendale (R-Montana).

“The Cleland-Dole Act gave us some authority that we are working to codify into regulation,” Shute said. “That will allow us to take action."

In the meantime, the VA has taken action to correct the problem that led to the years-long data matching issue.

"If they would wipe that [debt] clean because that causes anxiety and causes fear," Pierce said. "It's bad enough that the VA doesn't give you a very much increase every year."

For those impacted, the VA encourages veterans and survivors to visit their debt management website or call 800-827-0648. They also say they will be reaching out directly to affected veterans to let them know that debt collection has been paused.