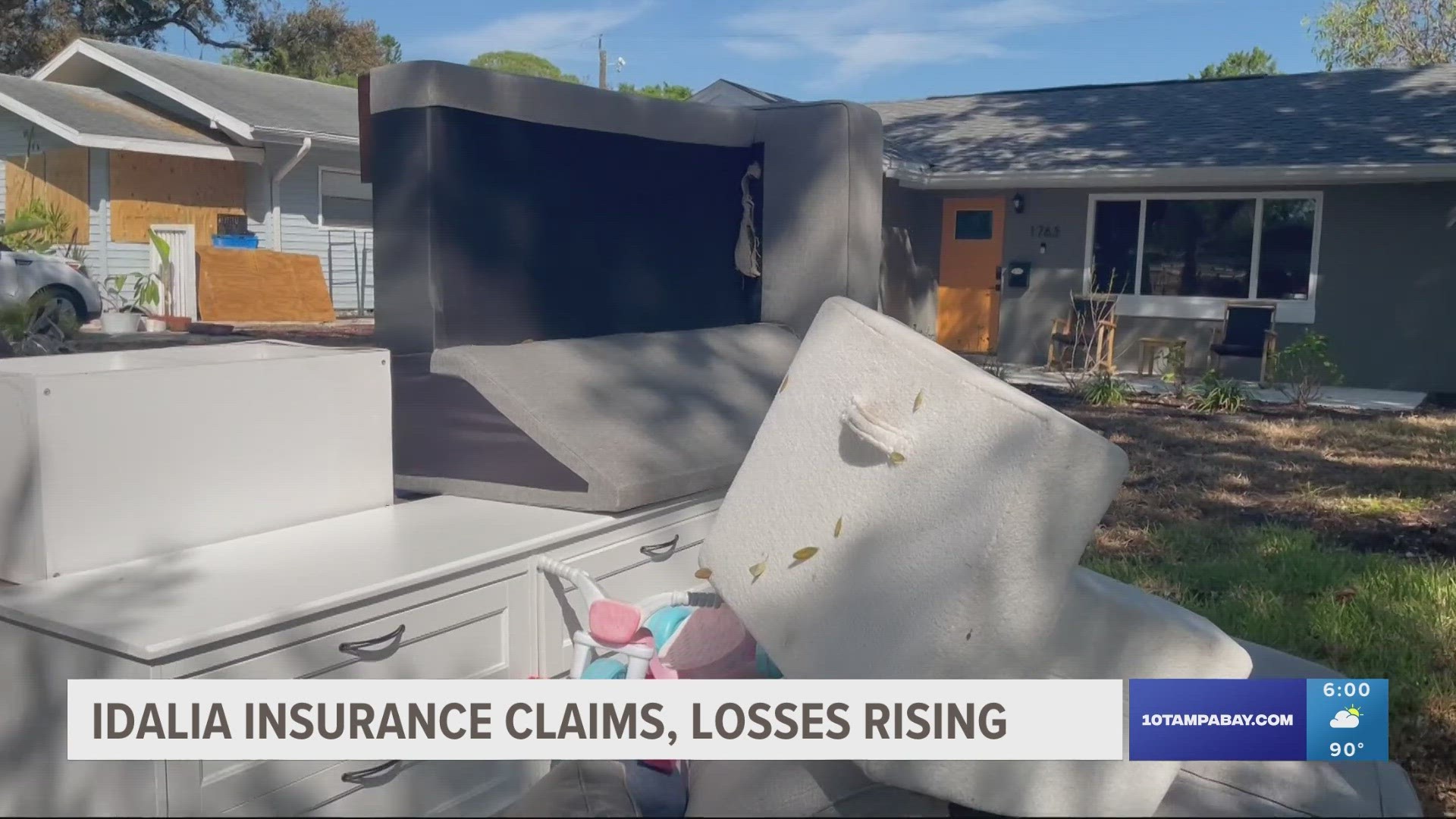

ST. PETERSBURG, Fla. — The number of insurance claims and the estimated value of losses are piling up after Hurricane Idalia flooded homes along Florida’s Gulf Coast two weeks ago.

According to the state’s Office of Insurance Regulation, the state estimates Idalia insurance losses have surpassed $175 million thus far. Those filing claims may not be the only ones who will see financial impacts from the storm.

Nearly 19,000 claims have been filed statewide, roughly 4,500 of those both open and closed have been paid out, and another 12,000+ are still open, according to data posted on the OIR website.

Working on filing a claim or have done so already? Keep a close relationship with the adjuster, Mangrove Financial Group Insurance Advisor Michael Sawa suggests.

"Ask lots of questions, follow up. Be proactive,” Sawa said. “Take photos of all the damage, document everything."

He encouraged people to call their insurance company as soon as possible to file claims.

Sawa says the process to get payment can take some time, but if you need financial help immediately, there are ways to get an advance. If that advance is more than you can claim, you’d have to pay the difference back.

“If you need money now you can get money soon, but outside of that you do have to be a little bit patient with the payouts,” Sawa explained.

“The fastest way to have a claim settled is to call the insurance company, make a claim, and avoid the ‘Public Claims Adjusters’ and attorneys,” Kathy Walsh with Coast-to-Coast Insurance in Tampa said. “Also it is imperative not to sign your insurance benefits over to the remediation company or the contractor."

With millions being paid out from another storm like Idalia – brace yourself – the impact could reach further even to those who may have escaped without damage, particularly when it comes to already rising auto and home insurance premiums.

“My concern as an agent right now is how it is going to impact auto insurance rates. We've already seen auto insurance rates skyrocket,” Sawa added. "50 percent increase, 100 percent increase across the board. So now with more auto claims from Idalia, I don't see that relief coming."

How much of a bottom-line increase will be more apparent in the months to come, when insurers adjust rates.

“Hopefully long-term effects aren't as bad, but it's still not good, there are millions upon millions getting paid out," he said.

If you have filed a claim and are having issues, the state encourages you to report it by clicking here.