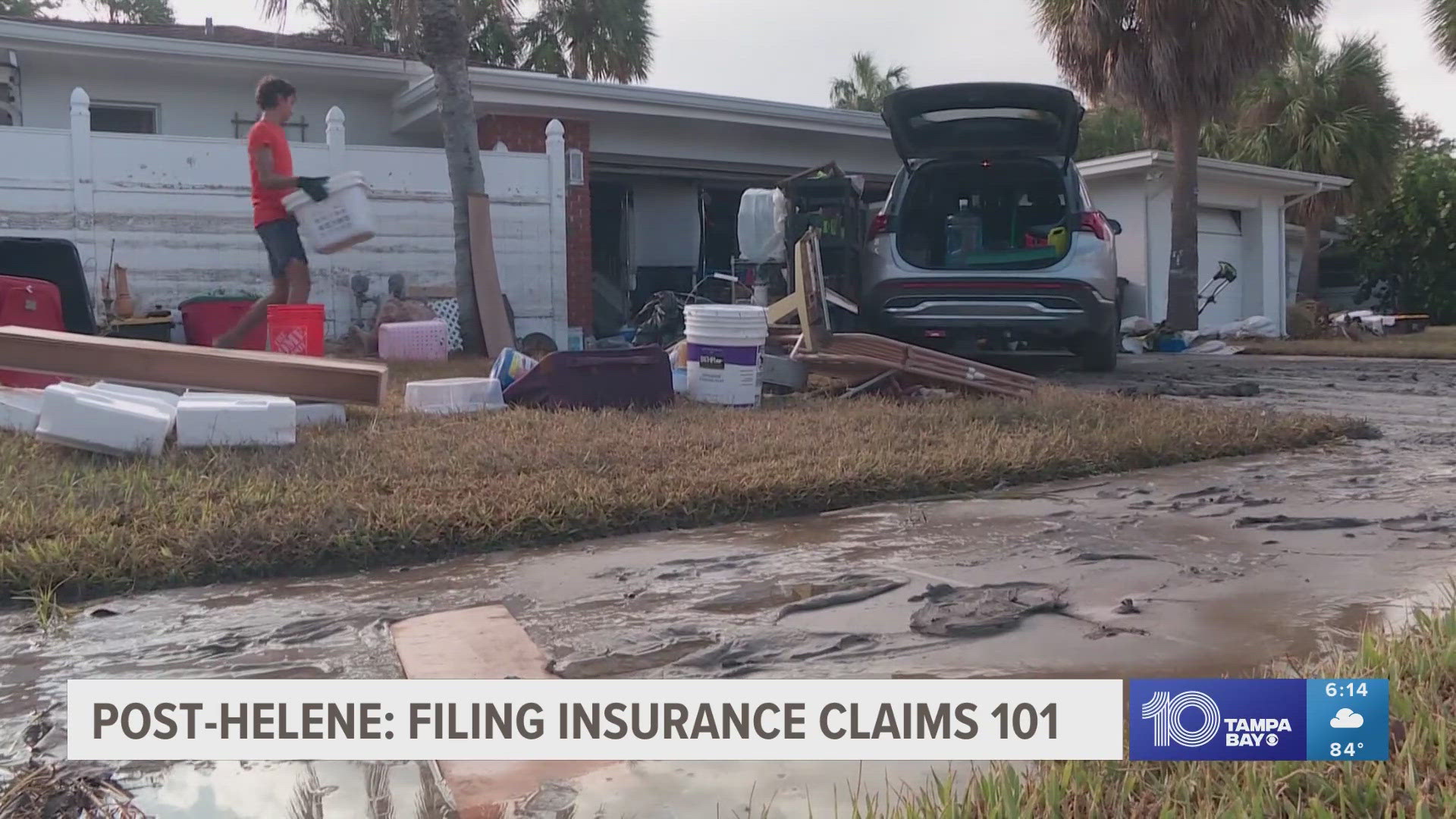

ST. PETERSBURG, Fla. — In Florida, Hurricane Helene has caused more than $500 million in estimated property damage and part of 50,000 insurance claims made since the storm, according to state data.

As the massive cleanup continues, both numbers are expected to rise in the coming days.

Helene brought widespread devastation along the Gulf Coast, sending feet of water and sand into homes and businesses. Since most of the damage was caused by storm surge, those claims would be made through your flood insurer, property insurance only covers damages caused by high wind or other factors.

If you are one of the many who will need to make an insurance claim, St. Petersburg Attorney Charles Gallagher talked to 10 Tampa Bay about 10 things you need to keep in mind:

- Act soon: Make your claim as soon as practical, the sooner the better. Call your insurance carriers and make a FEMA claim as well.

- Document your claim: Take photos and video of the interior and exterior of your home as well as damaged belongings. Take written inventory of all contents, with exact models, purchase price and as much information as possible.

- Mitigate damage: Nearly all policies have an obligation to prevent more damage and preserve the structure. That means cleaning up water and debris to prevent mold. You may toss things to the curb after you document it, but hang on to pieces of drywall or flooring that adjusters might want to see in person.

- Clear major repairs with the insurer: You don’t want to give a reason to deny your claim based on spoiled evidence. There could be a question as to causation and the rapid repair of your residence before exhibiting the property could result in issues.

- Check Loss of Use Benefits: Some policies will offer assistance to impacted homeowners by providing money for hotels, rentals and dining out while homes may be unlivable. Check your policy to see if you have the benefit.

- Be Patient With Adjusters: You’ll likely be dealing with an adjuster from out of town, they will be inundated with claims and will get limited time with them in person.

- Keep interactions to a minimum: Less is more, don’t tell them what you think happened, just exhibit the property. “Gratuitous words may all invoke coverage defenses,” Gallagher said.

- Communications in Writing: Phone calls don’t tell the story, make sure communications with your carrier and adjustor are done via text or email, to make sure there is proper documentation.

- Be wary of contractor solicitation: Be wary of any contractor who comes to your door and wants cash. Understand the importance of an assignment to benefits document you are requested to sign. Make sure an adjustor that comes to your home, comes directly from your insurance company, which won’t cost an additional fee.

- Ask for an advance: You can ask your adjuster for an advanced payment to help jumpstart your recovery, while the rest of the claim is processed.

For damage caused by winds, those claims would be made with your property insurer.

If you do not have a flood insurance policy, you may be eligible for some assistance through FEMA's disaster relief program.