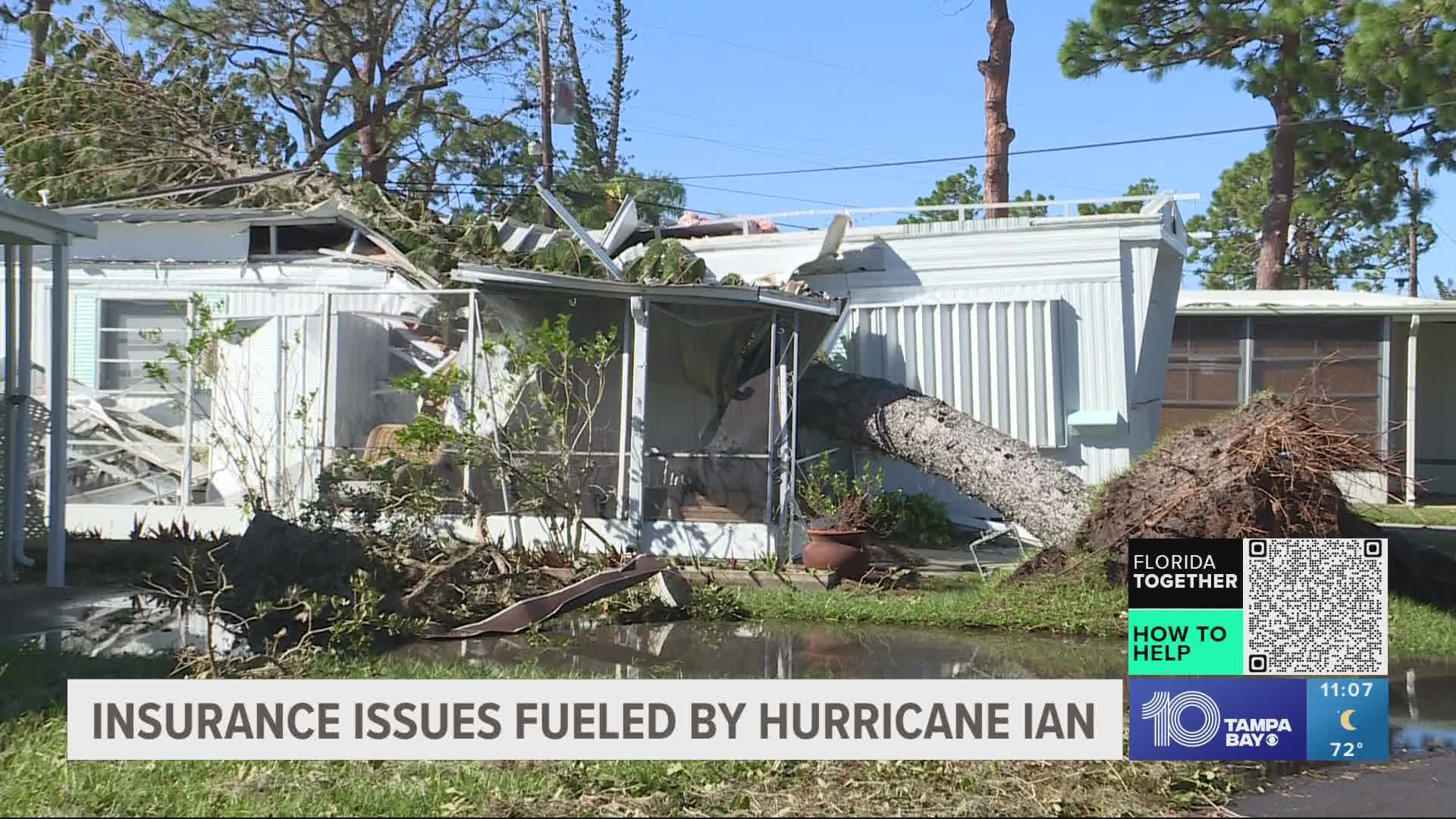

PINELLAS COUNTY, Fla. — In the aftermath of Hurricane Ian, Florida's property insurance market is still in turmoil. Mark Friedlander from the Insurance Information Institute says many homeowners without flood insurance are now left with a lifetime of hard work…washed away.

“Florida already had the most volatile home insurance market in the US,” he said. “The devastation of Hurricane Ian, for many families, is going to be catastrophic because they didn’t have flood coverage.

"Every Floridian should have flood insurance…it doesn’t take a hurricane to cause catastrophic flood damage.”

The Federal Emergency Management Agency says that just one inch of water in an average-sized home can cause more than $25,000 in damages.

While many families are forced to start over because of flood water, others are still searching for companies to simply protect their homes from other issues as the Florida property insurance market remains chaotic.

“Things were really in collapse prior to Ian,” Sen. Jeff Brandes said. “Ian has only taken this house of cards that was already collapsing, and added a Category 4 hurricane to it.”

Brandes called for a special session earlier this year to address issues with property insurance companies. Now, he says he’d like to see the governor assemble a task force to come up with concrete ideas to stabilize the market.

“The task force needs to be put together in the next two to three weeks,” he said. “I think they need to be given a deadline of about a month to get everything done, and then I would expect that they would call a special session and be done before January.”

For now, experts like Friedlander are advising people to look into flood insurance policies and to call their agents to make sure there aren’t gaps in their property insurance coverage because hurricane season isn’t over.