CLEARWATER, Fla. — More than one month since Hurricane Debby made landfall, many in Tampa Bay are still rebuilding.

New numbers show the Tampa Bay area leads in Citizens Insurance claims, meanwhile state data shows thousands of claims are being denied.

"Something needs to change," said Shannon Hinkle of Clearwater. "The fact that we're so vulnerable is very sad as a community."

Her mobile home park was among the areas heavily inundated by flooding. Waist-deep water where alligators posed a threat prompted high-water rescue vehicles to be called in.

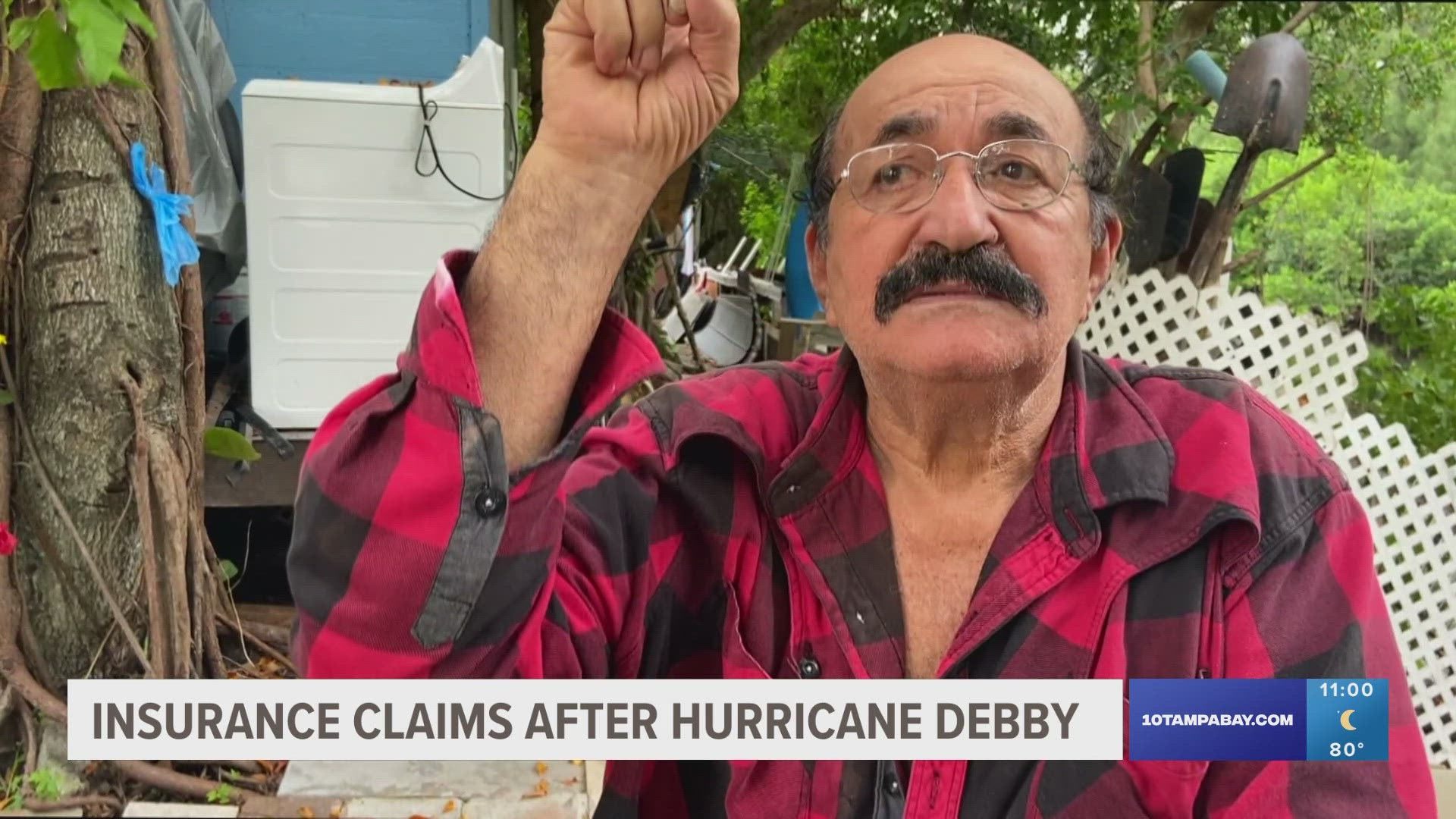

Romilio Pupu Moreno of the same community said the water drenched everything inside his home including his furniture and other belongings.

The state’s Citizens Property Insurance Corp. had received nearly 2,300 claims from Hurricane Debby as of late August, with the largest numbers coming from the Tampa Bay region, according to data posted on the insurer’s website.

The largest number of claims, 585, were filed in Pinellas County, followed by 343 in Hillsborough County, 215 in Sarasota County, 204 in Pasco County, 142 in Manatee County and 97 in Hernando County, according to the data.

Meanwhile, data from the state also showed thousands of claims are closed without payment.

Of the nearly 20,000 claims, nearly 60% of claims have been closed. Of the cases closed, 6,447 claims are closed without payment, reported the Florida Office of Insurance Regulation.

Mark Friedlander with the Insurance Information Institute said it's important for Floridians to remember to have both property and flood insurance.

Friedlander notes damage in the Tampa Bay area from Debby was in large part flood-related.

"You always need separate coverage either through the National Flood Insurance Program or a private flood insurer policy," Friedlander said.

Friedlander recommends this to be necessary for even areas not as high risk for flooding.

For instance, the Laurel Meadows neighborhood in Sarasota was among the hardest-hit areas. The community isn't known for being in a high-risk flood zone.

Friedlander also notes significant flooding doesn't have to stem from a major storm like Debby, but from regular storm events. The area saw major rainfall in a short amount of time last week, stranding drivers for hours and flooding vehicles.

Many residents were critical of local drainage and stormwater systems including Hinkle.

Hinkle, a native of the area, hopes more can be done by the government in all sectors, especially at a time when cost of living continues to impact Floridians and insurance costs aren't affordable to some.

""There's no telling what we're going to go through. It's just a matter of trying to survive," she said.

The Citizens Board of Governors’ Claims Committee is scheduled to get a briefing about Hurricane Debby during a meeting Thursday.

Recent data from the state shows total estimated insured losses to be nearly $121.5 million.