TAMPA, Florida — In just the past few months, Florida has seen major names in the insurance industry, Farmers, AAA and most recently Progressive aim to pull back their presence in Florida’s property insurance market, essentially saying it’s too risky.

The state-backed Citizens property insurance, which has ballooned to hold 1.4 million policies, is also aiming to limit its risk exposure, in turn trying to sell off nearly 400,000 policies.

At the same time, new companies have been popping up, approved by state regulators to take on or write new policies in Florida.

So, who are these newer insurers willing to take on the risk? 10 Tampa Bay visited one based in the Tampa Bay area.

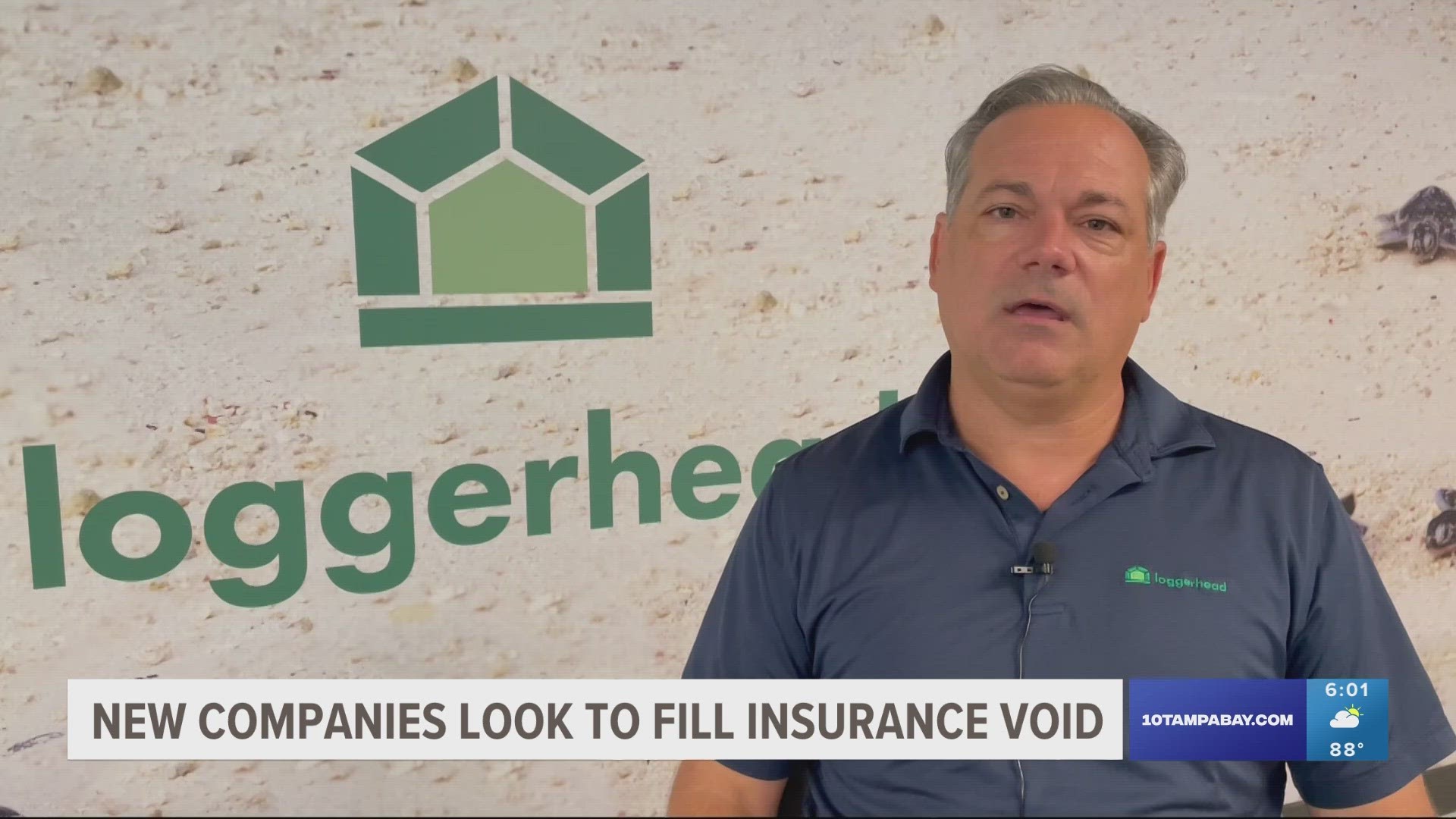

Jim Santo and Todd Dixon are the co-founders of Loggerhead Insurance, a roughly year-old Tampa-based company planning to offer home insurance policies to some of the 100,000 policyholders set to be dropped by Progressive next year.

“In the case of progressive, they're looking to rebalance, they looked at their country-wide exposure,” Santo said. “Loggerhead is a Florida-based company, and we have no plans to move outside of Florida.”

10 Tampa Bay met the company brass at their new office off Dale Mabry, they now have more than 40 employees and about 16,000 customers so far. Santo says they decided to enter the market because they saw the growing demand for coverage.

“People need homeowners’ insurance in Florida, and we wanted to create more of a supply,” Santo explained. Looking to meet the demand, as many know just the trouble of finding coverage.

While the state-backed Citizens is looking to cut back, their policyholders don’t have to jump ship if it will cost them more than 20%. Santo says Loggerhead can offer competitive rates.

“We've done our own analysis to know how our pricing lines up and we plan to provide a competitive product,” Santo added, saying recent changes put forth by the legislature make them feel more confident in their growth.

Those getting dropped by Progressive next year don’t have to go with Loggerhead, it’s not a binding offer. But it is an option and in Florida’s market, options are a good thing.

“There'll be several new companies writing business in Florida, five companies have been approved this year by the state regulator, so you'll have opportunities to shop elsewhere,” Mark Friedlander with the Insurance Information Institute said.