TAMPA, Fla. — The number of Americans filing for unemployment continues to soar, breaking records week by week. Last week, 16.8 million people were out of work across the country.

Many people are trying to find ways to make ends meet. Others are looking for ways to benefit from the devastating impact COVID-19 has had on the American economy.

Robert Harwood, the president of Harwood Financial in Tampa, says his firm is extremely busy right now. He says his employees are fielding calls every day, trying to offer financial advice for those trying to make the most of their money. Harwood says the best advice for anyone is to stay calm.

"Number one, don't panic. Think about what you need to do and what you need to get done. The coronavirus won't be here forever," said Harwood.

If your family is struggling to make ends meet, Harwood has some advice.

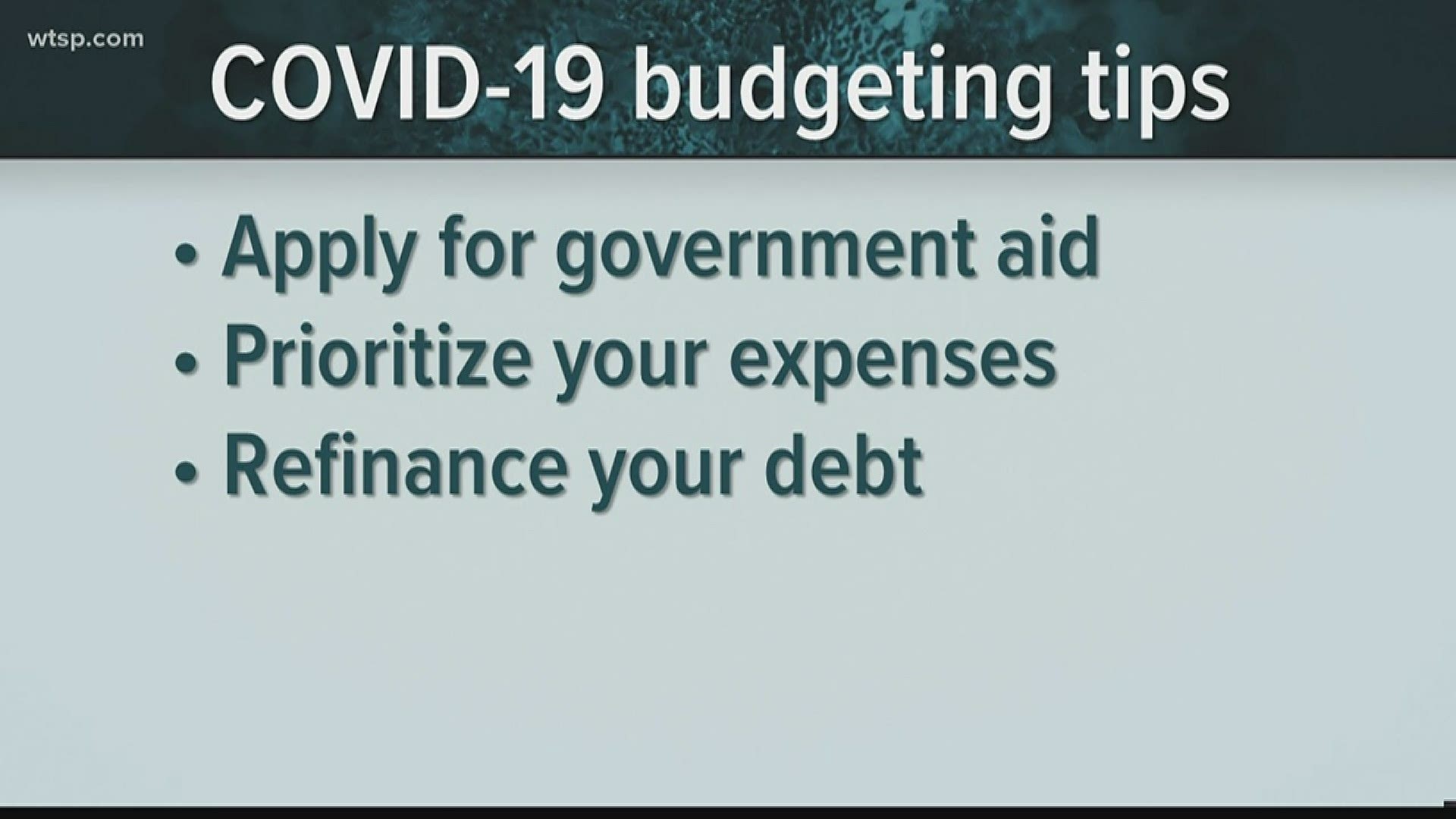

- Apply for government aid. It can be a lengthy process and frustrating to get registered, but it will provide an income to help you make it through this time.

- If you're in need, search for local community outreach programs. Many non-profits are offering meals free of charge.

- Prioritize your expenses. Put bills like student loans and mortgages with forbearance on the back burner for now. "Think about the things you absolutely must do. You have to feed your family and you've got to keep the lights on in your house," said Harwood. He suggests taking advantage of federal protections put in place by the CARES Act, like the ability to negotiate your rent. You can also try calling your utility providers to ask if they'll waive late fees or work out a payment plan.

- Cut out unnecessary expenses. This could be any subscription services, take-out or new clothes.

- This tip is good for anyone looking to put some money back into their pockets: Refinance your debt. "When it comes to credit card, car debt, any other debt, any reduction is a good thing. One of the opportunities here is if you can get your debt to a lower interest rate," said Harwood.

- If you own a home, now is a good time to refinance your mortgage as well. "Think about how long you'll be in the home. The typical number you're looking for is a one percent reduction in the rate you're paying on your mortgage if you're in the home five years or longer," said Harwood.

- Don't panic if your 401k balance has dropped. You shouldn't pull it, unless you want to move it into a Roth IRA. "You may be down ten, fifteen percent, whatever it is. Take that money and move it over to a Roth. You'll have to pay taxes on it, but you're moving it at a smaller value, but when the recovery comes, all that growth will be tax-free."

Harwood Financial hosts a daily conference call as a free service to the community during the COVID-19 pandemic to answer any finance questions.

You can more find information here.

- These essential workers could get $25,000 in hazard pay under 'Hero Fund' plan

- Union: Chief said deputy's coronavirus death caused by homosexual events

- IRS deposits first economic aid payments

- FedEx worker sanitizes package before delivering to immunocompromised home

- Publix employee at South Pasadena store tests positive for coronavirus

- Hotlines, websites offer the latest on COVID-19

FREE 10NEWS APP:

►Stay In the Know! Sign up now for the Brightside Blend Newsletter