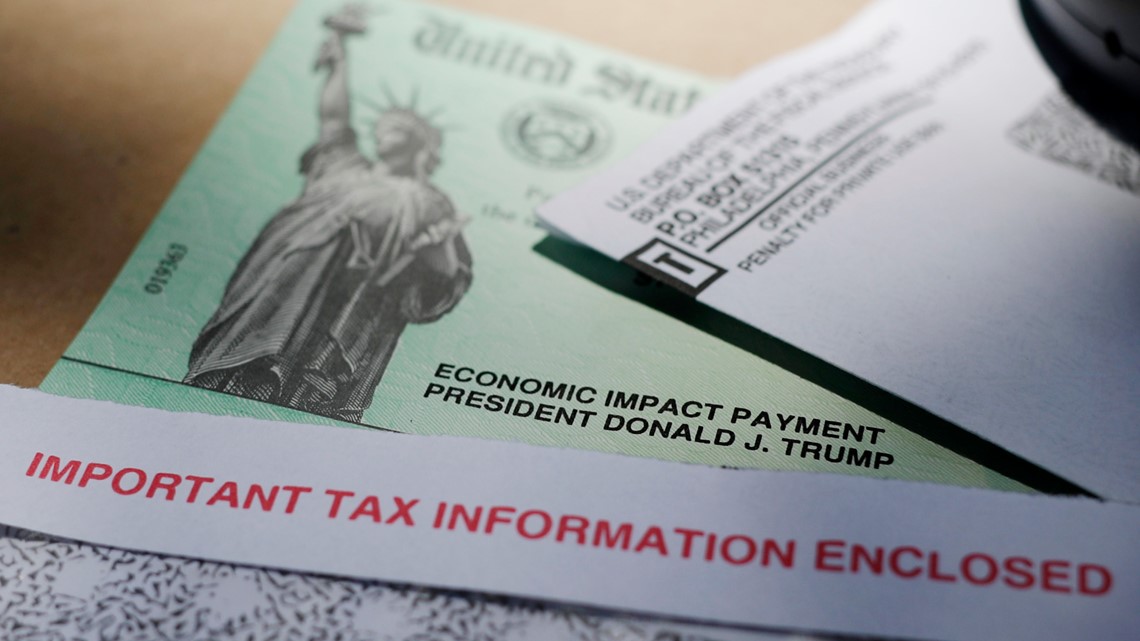

WASHINGTON — Over the past month, the government has been sending out tens of millions of coronavirus stimulus payments.

For most people, the $1,200 one-time payment was automatically deposited into their bank accounts, while others had to wait for a check in the mail. And now this week, the U.S. Treasury and the IRS have begun sending pre-paid debit cards with the stimulus payments to nearly four million Americans.

While some will receive these pre-paid debit cards, the IRS on Wednesday confirmed on its website that there isn't a way to specifically ask for your economic impact payment as a debit card at this time.

The IRS explains all the details in the "frequently asked questions" section online and states that those who don’t receive their stimulus money by direct deposit should get their payment by paper check, while a debit card will go out in "a few cases." The agency said the Fiscal Service Bureau will determine which taxpayers get a debit card.

The bureau is another part of the Treasury Department that works with the IRS to distribute payments. Treasury Secretary Steven Mnuchin said the prepaid debit cards "are secure, easy to use, and allow us to deliver Americans their money quickly.”

Taxpayers who receive an "EIP Card" (Economic Impact Payment) can use it for purchases, withdraw cash from in-network ATMs and transfer funds to their bank account without fees.

The debit cards will be sent to taxpayers whose tax returns were processed by the IRS Service Centers in Andover or Austin. They can be used online at ATMs or at retailers where VISA is accepted.

Instructions for activating and using the debit card will come in the mail with the card.

The CARES Act passed in March provides $1,200 to most individual American taxpayers who earned less than $75,000 or $2,400 to couples who earned less than $150,000. The amount is based on either their 2018 or 2019 tax return, whichever is the most recent that has been processed by the IRS. There's an extra $500 for each dependent child under the age of 17.