ST. PETERSBURG, Fla. — You've heard about the property insurance crisis here in Florida.

New estimates from the Insurance Information Institute show Floridians are now paying three times as much as the average in other states at an average of $4,231 a year. The U.S. annual average is $1,544.

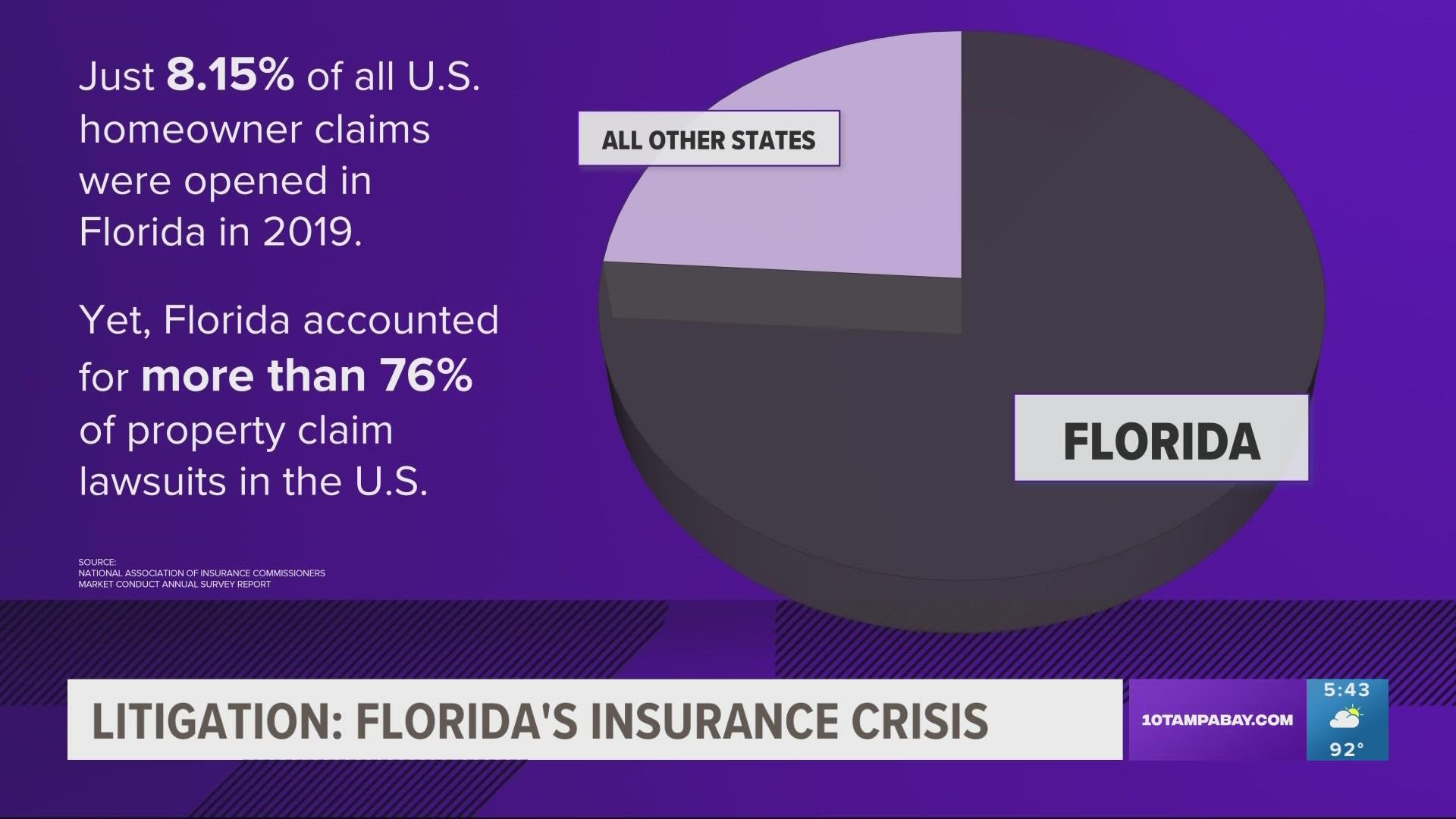

A big part of what's driving up the costs is the amount of litigation. Florida makes up nearly 80 percent of all the insurance lawsuits in the country but just a small amount of the claims.

All those lawsuits have forced at least four insurers out of business this year. Mark Friedlander, a spokesman for Triple-I, says about a half of a dozen others are on the brink of collapse. Many insurers have cut the number of policies, and there aren’t as many options to choose from to try to get a better rate. He believes lawmakers in the special session didn't go far enough to address contractors taking advantage of homeowners.

“We've heard from homeowners that don't even realize they're being scammed. Recently, a homeowner told us that they've never filed a claim, and we asked them well didn't someone come to your door and have you sign what's called assignment of benefits, and you turned over a roof replacement to this contractor. They didn't understand, that's an insurance claim,” Friedlander said.

He adds Triple-I recommends if any contractor comes to your door unsolicited, tell them to leave.