Still awaiting a stimulus check from the government? You're not alone.

The IRS said Monday that it has issued 130 million payments totaling $200 billion, but that means about 20 million Americans are still waiting for relief, CBS News reported.

The $2 trillion relief packaged passed in late March included stimulus check payments of $1,200 to most Americans who file taxes individually and make less than $75,000. Married couples who file together and earn up to $150,000 would get $2,400. There's also an additional $500 for each child under 17.

The amount per check goes down as income goes up, with a cap of $99,000 a year for individuals and $198,000 for couples.

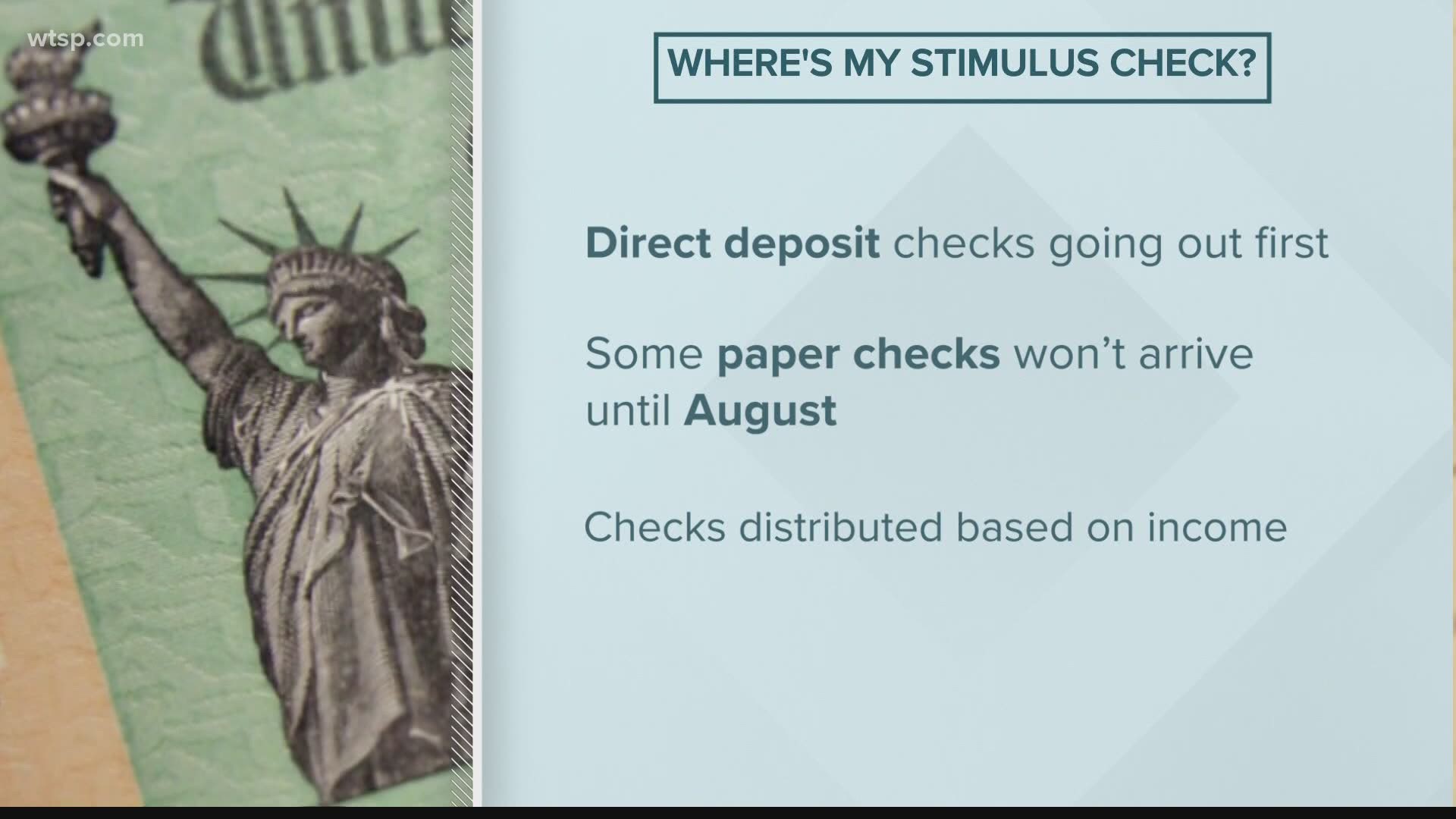

However, it's still not clear when exactly people waiting on money will see it land in their bank accounts or mailboxes. CBS said that answer could depend on things like when most recent returns were filed and if the IRS has consumer banking information.

Here are some reasons why you may still be waiting on a stimulus check:

- You recently filed taxes: If you recently filed your taxes, the IRS could still be processing that, which means you'll see a "payment status not available" on the IRS "Get My Payment" site. You could see your stimulus check arrive later than others who filed earlier this year.

- You have a high income: Those who make less than $10,000 will get checks first. The IRS then sends out more checks each week by income level. Last month, the Associated Press said it could take up to 20 weeks for all the checks to go out. If your income is more than $75,000 but under $99,000, you could still be waiting on a stimulus check.

- The IRS doesn't have your banking information or has the wrong banking information: In both cases, you should be receiving a paper check with the address from your last filed taxes. However, the IRS prioritized direct deposits over paper checks, so there will be a delay.

- You don't file taxes, but you're not on Social Security: The IRS said non-filers should enter the proper information here.

- You owed the IRS and used direct pay: If you used this method, the IRS says to enter proper banking information here.

And, some Americans who have received a stimulus payment found it to be less than expected. Here's why that may be the case:

- The IRS could be going off a different tax return

- Claimed dependents aren't eligible for the extra $500 payment

- College students and people 17 and older who are dependents don't qualify

- Past-due child support was deducted from the stimulus payment

- The stimulus is not protected from garnishment by creditors

Where is your stimulus check? Track your payment and get the latest information from the IRS through "Get My Payment" here.

What other people are reading right now:

- Disturbance near Bahamas could strengthen into season's first tropical system

- Naples beaches to open but with shortened hours, restrictions

- People trash Cocoa Beach with 13,000 pounds of litter after it reopens

- Need a COVID-19 test in Hernando County? Here's your chance

- Report: Company behind flawed unemployment website says Florida got what it asked for

- Disney World not accepting ticket reservations before July 1

- Coronavirus in context: Florida COVID-19 cases explained in 5 charts

►Stay In the Know! Sign up now for the Brightside Blend Newsletter