JACKSONVILLE, Fla. — The identification verification company “ID.me” is shooting down about $1 billion in fraudulent unemployment benefits per week, the company said.

The Florida Department of Economic Opportunity has announced a sharp increase in fraudulent unemployment claims this year, and partnered with the company to verify the identities of those filing for unemployment benefits.

“The scope of the problem is that $200 billion of fraud is going to fraudsters,” said Pete Eskew, Senior Vice President of Public Sector at ID.me.

Eskew said that money is often wasted on scammers overseas.

“We’re talking organized crime in China, Ghana, in Russia, that have left the shores of our country already,” Eskew said.

Eskew said the scammers are often receiving money in the following ways:

- Basic Identity Theft (18% - 20% of Claims): An attacker leverages stolen personal data to file a claim in the victim’s name.

- Social Engineering (7.5% - 10% of Claims): An attacker convinces a victim they are verifying their identity for a job or to get prize money

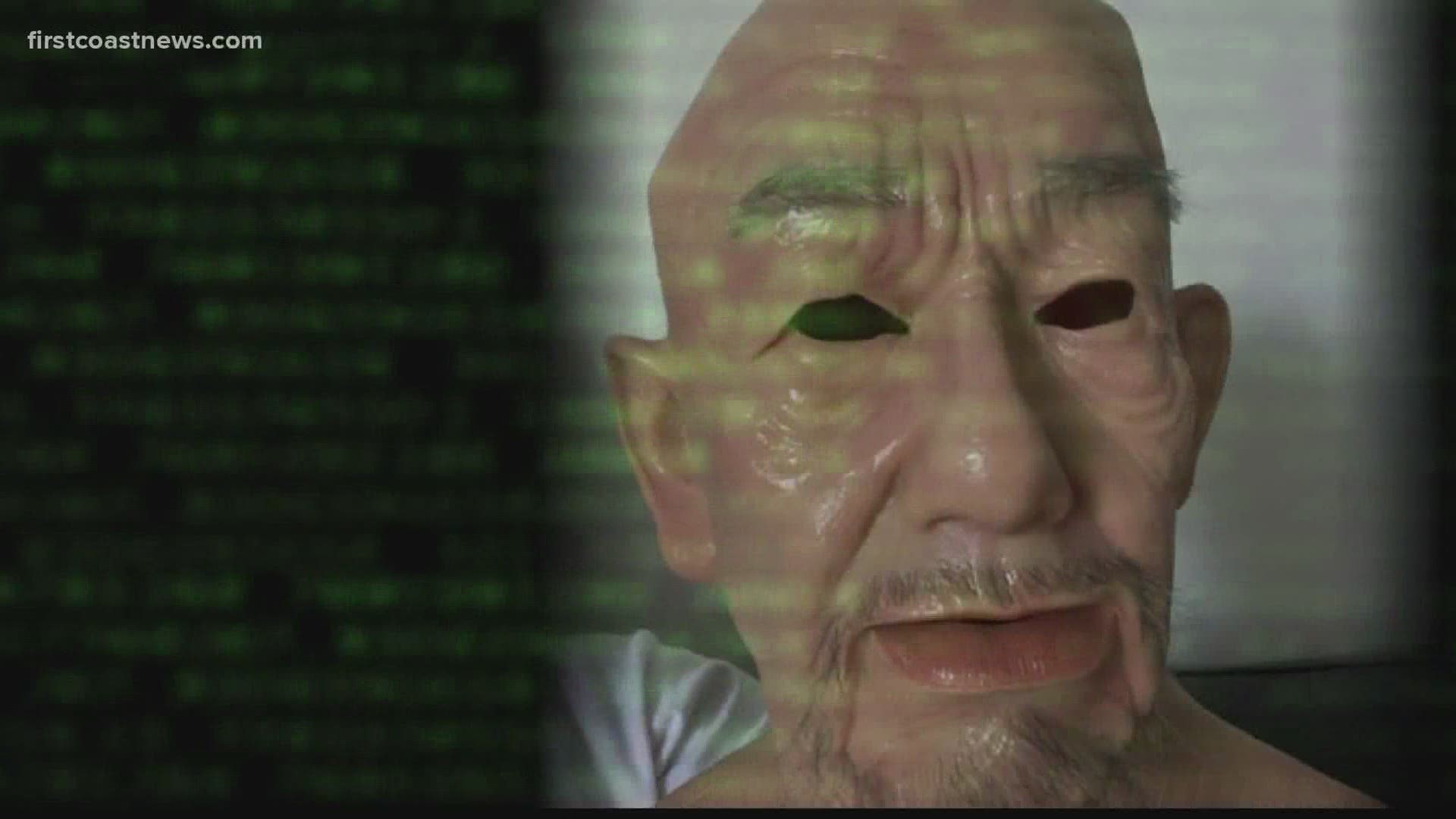

- Face Matching (2% - 2.5% of Claims): An attacker holds up a picture, video, and increasingly a computer generated 3-D printed mask of the victim’s face.

- Prisoner Fraud (Unknown % of Claims): Incarcerated individuals who are ineligible to file claims do so anyway.

- First-Party Fraud (Unknown % of Claims): An attacker convinces a mule (an individual who knowingly aids the attacker) to let the attacker file a claim in the mule’s identity in exchange for a cut of the claims payment. The mule then contacts law enforcement and pretends to be a victim of identity theft.

- Synthetic Identity Theft (Unknown % Claims): An attacker creates a fictional identity in credit records and uses the fake or synthetic identity to file a claim for an identity that does not exist

These are all reasons why DEO is collaborating with ID.me.

“ID.me comes in and blocks that right away because we have access to different checks that prevent that identity theft marker from coming in,” Eskew said.

ID.me requires personal information and a picture of your government issued ID.

Its most advanced feature is its live facial recognition, requiring you to look at the screen and follow prompts as the app records you.

“We are estimating we are blocking about a billion dollars of fraud a week,” Eskew said.

That’s across the 19 states the company serves. Eskew says tens of thousands of fraudulent claims have been blocked in Florida alone.

“We have found ourselves at the center of this fight that we take very seriously,” Eskew said.