ST. PETERSBURG, Fla. — In the aftermath of Hurricane Ian, Florida's property insurance market is still in turmoil.

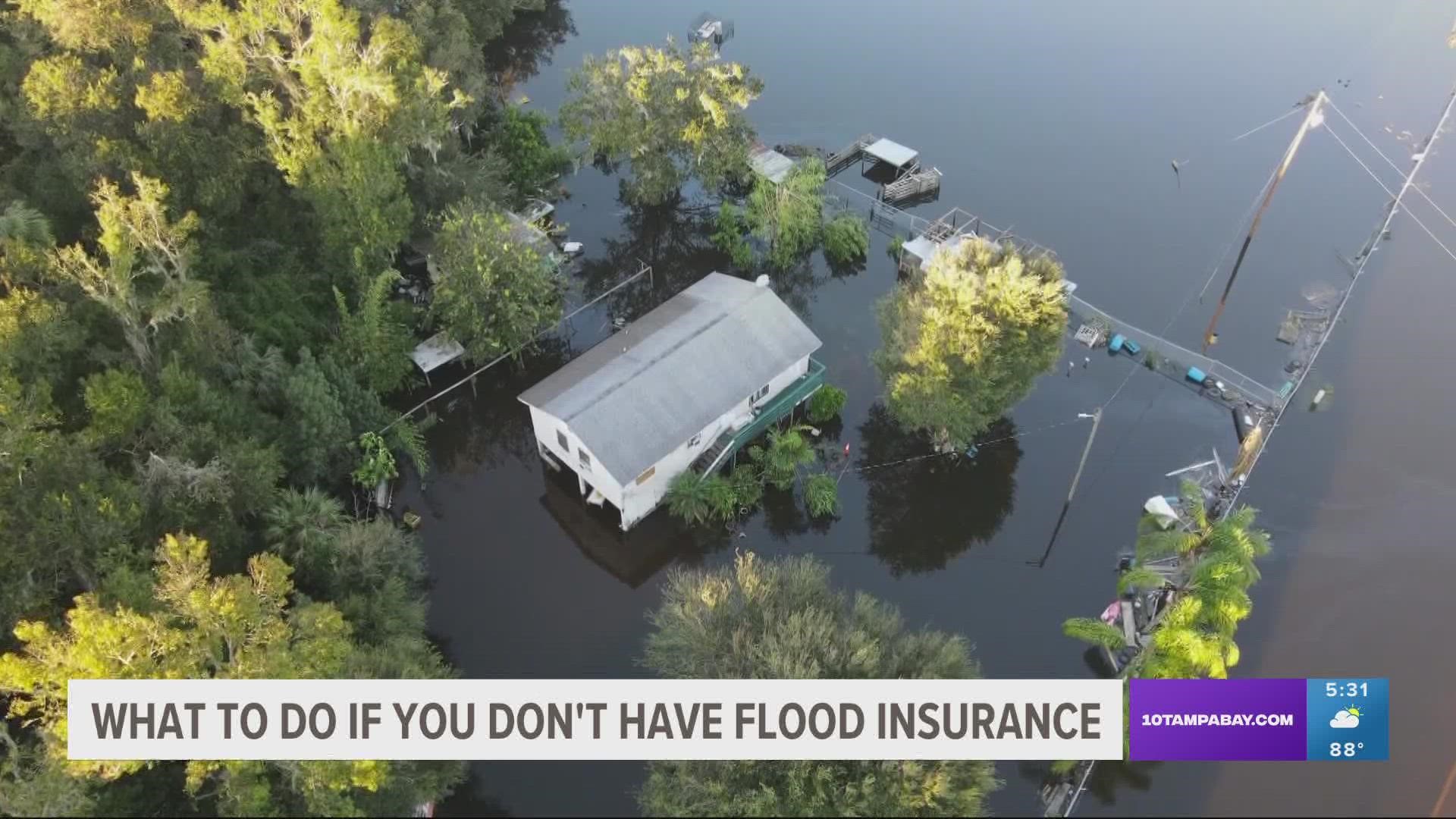

Polk County is one of the inland counties that were hit hard with flooding, and some homeowners didn't have flood insurance before the storm hit.

For those homeowners, what are their options?

“If that's the case, most likely you would be to apply for a FEMA individual grant to help you recover," Mark Friedlander from the Insurance Information Institute said. "But in our case, FEMA grants only pay a small amount, typically about a $10,000 cap is what we see. So say you start with $50,000 blood loss insurance. You are going to be paying that out of pocket.”

Macallister Green lives near the Peace River in the county, and he made sure his insurance covered flooding before the storm hit.

“Thankfully, up here, we're pretty close to the front of the park, so it wasn't too bad," he said. "Maybe a couple of feet up here, down there at the other end, it's really bad, though. Just being close to the river like that, I figured it was a good idea to do that.”

Further south in Wachula, Tammy Daw is looking for other options to cover the costs after her insurance turned her down.

“The city came by today and told me it was a total loss… and I'm like, a total loss? Is FEMA going to write me a check? Because my insurance company done told me no,'” she said.

People living in many areas are required to have flood insurance, but for those living in some flood-prone spots, that’s not always the case.

"People need to have flood insurance," Libby Baney, an attorney with Faegre Drinker Biddle & Reath, said. "It's hard to remember that when you're not in a floodplain, and if you're not mapped in and we have a problem with our maps, being congress', this spent many, many sessions talking about the need to update our maps."

You can also file for an SBA disaster loan, but experts say in the meantime, it’s a good idea to get ahead now, before the next storm hits.

"Even if you're not in a floodplain or even for not mapped in, you still need flood insurance, because you just don't know what's where the storm is going to turn,” Baney said.