ST. PETERSBURG, Fla. — Two Red Mesa restaurants are accused of keeping bartenders' and servers' tips, in addition to other allegations, in violation of the Fair Labor Standards Act, the U.S. Department of Labor announced Thursday.

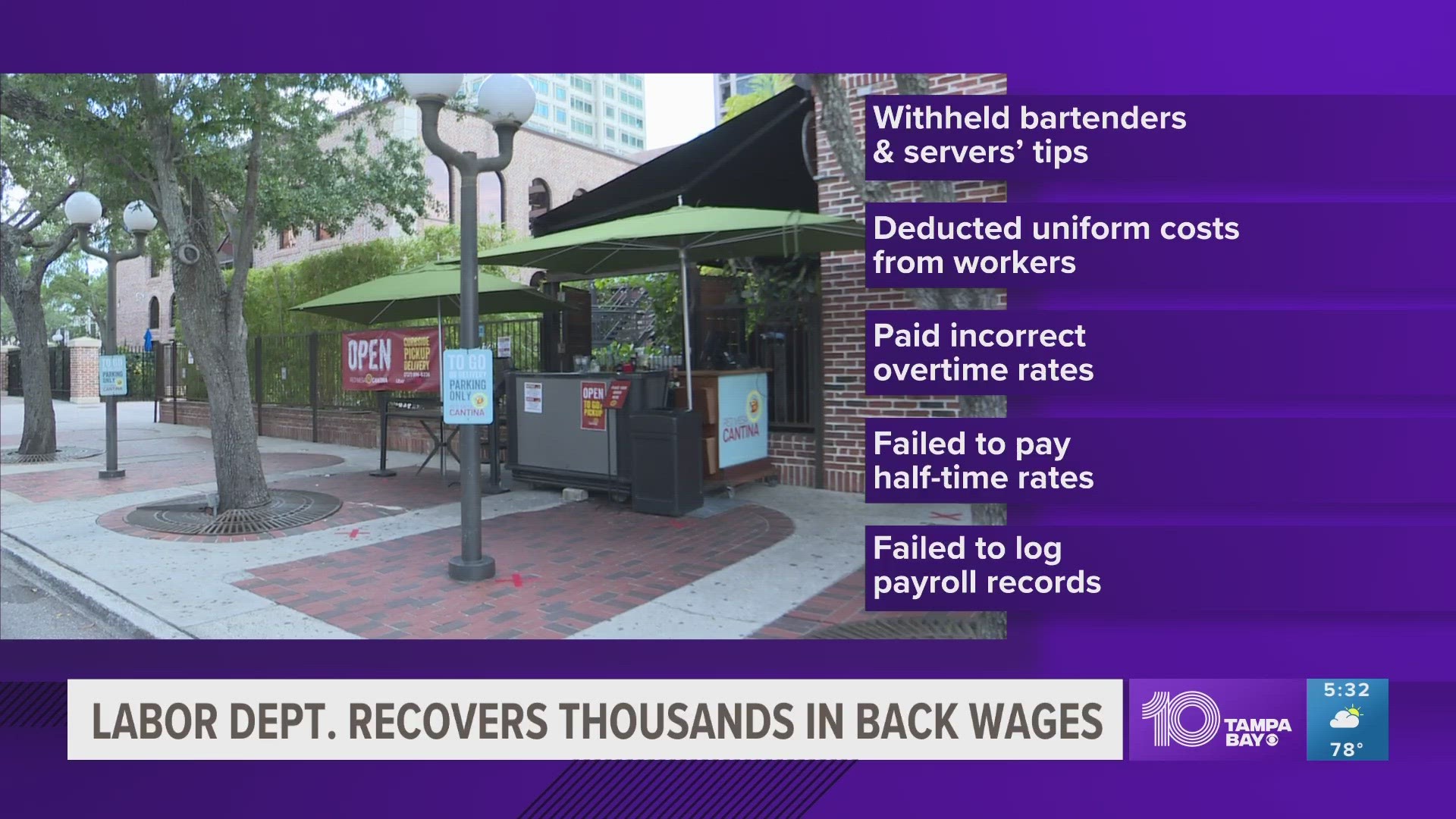

Investigators said in a news release that Red Mesa Inc., operating as Red Mesa Restaurant, and Veytia Ventures LLC, operating as Red Mesa Cantina, used the withheld money to pay for customers who skipped out on their bills. They, too, deducted the cost of uniforms from employees' wages, which led some workers to be paid less than minimum wage.

The Department of Labor's Wage and Hour Division ultimately recovered $190,730 in back wages and liquated damages for 89 affected workers.

Red Mesa was contacted by federal officials in 2021 regarding the possible violations and said it "relied upon contracted financial professionals to advise and navigate the extensive and complex regulations governing wage and hour guidelines." Its business with the unnamed firm was terminated.

Each affected employee was paid double and in full what was owed in 2022, the company said.

"A Department of Labor investigation in 2021 calculated amounts of overtime, uniform expenses and other monies owed to each employee. In 2022, we took that amount, doubled it, and paid our employees to make things right," said Peter Veytia, the owner and operator of Red Mesa Inc, in a statement.

"We were extremely distressed to learn about this situation in 2021, and have aggressively taken far-reaching steps to make sure something like this never happens again. As part of this process, we terminated the outside firm that had handled this part of Red Mesa’s business.

"As a family-owned, local business, we know we would never succeed without our high-quality employees. We want our employees to know they are being treated fairly every day."

The division also found the restaurants in violation of the following, it says in the release:

- Paid an incorrect overtime rate to tipped employees and failed to combine hours when these employees worked at both restaurants in the same workweek. By doing so, the restaurants paid overtime at rates lower than required by law for hours over 40 in a workweek and failed to pay for all overtime hours in some workweeks.

- Paid kitchen staff straight time regardless of how many hours they worked. By doing so, the employer failed to pay them the additional half-time rate required for overtime hours.

- Failed to log workers’ hours in payroll records correctly which kept some workers off payroll records.

“By law, two or more establishments that are commonly owned are considered a single enterprise. In this case, the employer assigned employees to work at two locations they owned. They should have added the hours worked at these locations together and paid overtime when the combined hours exceeded 40 hours in the same workweek,” Wage and Hour District Director Nicolas Ratmiroff said in a statement.

“Operating restaurants with the same owners under different corporate names does not remove that liability. Employers are responsible for understanding and complying with federal laws regarding pay practices.”