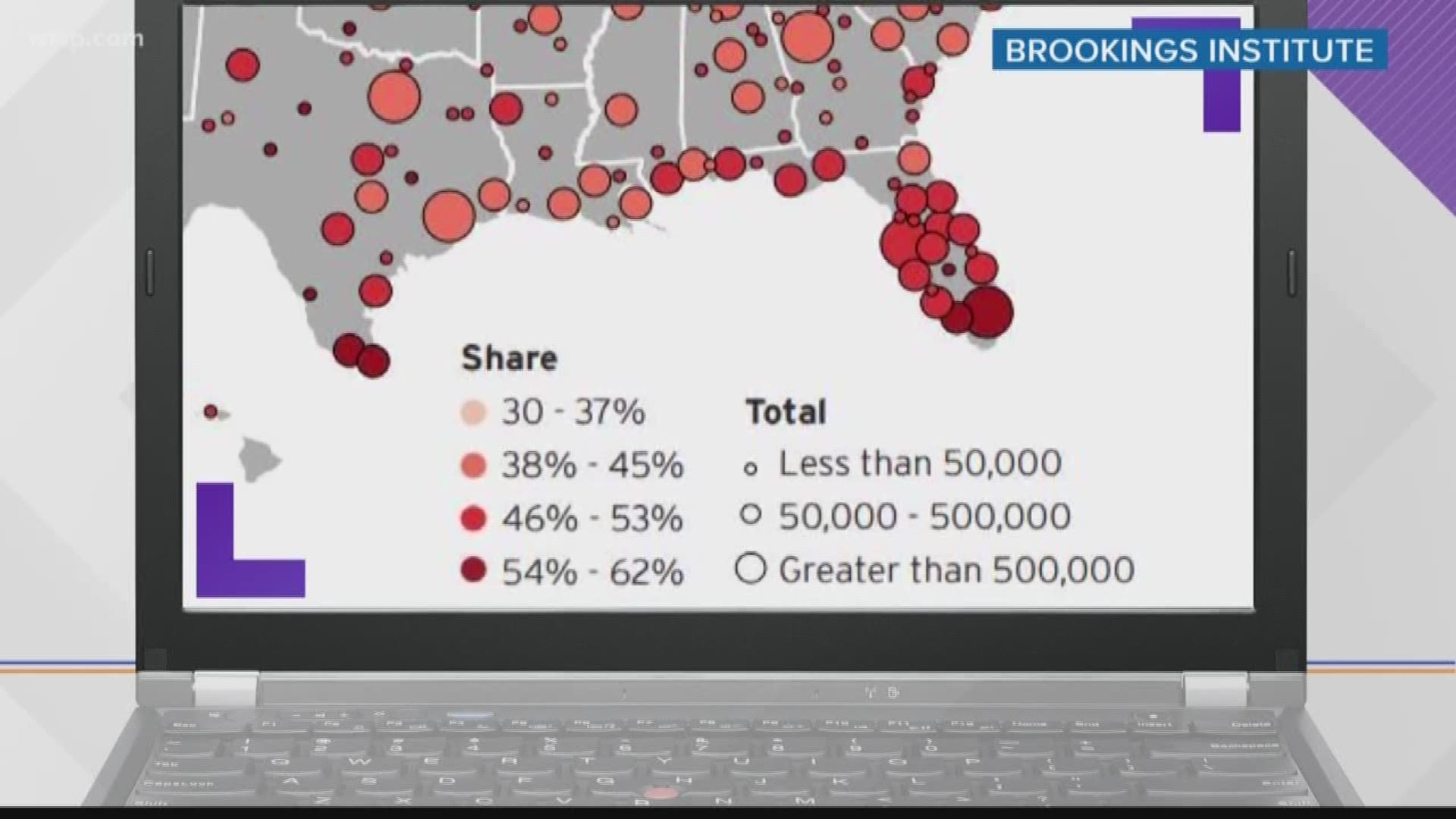

ST. PETERSBURG, Fla. — Almost half of American workers are working in “low-wage” jobs, according to new research by the Brookings Institute. The report, published in November, shows 44% of U.S. workers are employed in low-wage jobs that pay median annual wages of $18,000.

Florida appears to be one of the hot spots, with some of the heaviest concentrations of metropolitan areas with high percentages of low-wage workers.

“It is tough out there, it is tough, and money is really tight,” said Lisa Leslie, an Extension Agent for Hillsborough County and a certified financial planner and counselor.

“The best thing folks can do is really take a hard look at their money, what their income is and track their spending, and make sure they’re happy with their spending choices and, sometimes we just have to make difficult, adult choices," she said. "There’s no ‘yes or no’, it’s the best thing they can do for themselves but, understand that there’s no perfect. When we’re adults, there’s adult, hard choices, adult decisions, we just have to make some hard choices with our money.”

According to the data in the report, Sebring ranks sixth in the country for the highest share of low-wage workers. The report’s authors assert that places where the economy is based on agriculture and hospitality (i.e.: Florida), there are higher shares of low-wage workers.

But Leslie offered eight simple tips for anyone looking to stretch every dollar, whether they make minimum wage or a six-figure salary:

- Prioritize your needs.

- Track expenses.

- Communicate with family members and come to consensus about priorities.

- Try to set aside a small amount each week.

- Plan ahead for how you will spend a tax refund.

- Avoid expensive loans and too-good-to-be-true offers.

- Stay informed about free community resources such as: free entertainment events, local public library resources, and back to school fairs.

- Take pride in yourself for taking small, realistic steps.

“You’d be surprised because I know folks that are making a lot of money and you want more, and you want more, and so you’re not making ends meet," Leslie added. "So, we all have to make choices, it’s just some people have very difficult choices and they have to really think hard about how they’re going to spend their money. Don’t beat yourself up, just be happy with yourself - I face this, I’m facing this head-on, and I’m going to make the best choices I can.”

The MIT Living Wage calculator can help residents calculate their specific cost of living. The U.S. Private Sector can also help residents decide on the quality of jobs through the Job Quality Index.